Disruptive technology like blockchain has brought a radical change in the way financial institutions mutually interact while influencing the trade settlements process. Through this blog, let’s understand how capital markets are undergoing a massive transformation with blockchain integration.

Introduction of Blockchain in capital markets

Capital markets comprise a complex system with many stakeholders, including buyers, sellers, brokers, regulators, issuers, dealers, and fund managers. With its widely embracive characteristics – transparency, security, immutability, and decentralization capabilities, Blockchain, on the other hand, can completely disrupt the current centralized legacy systems. The p2p network capabilities, like the consensus mechanism, facilitate interaction between various participating nodes while cryptographic securities establish trust among the trustless. Both these characteristics of Blockchain bring down the transaction time while ensuring safety of the database. The transparency factor allows visibility of near real-time transactions making auditory trails transparent to all parties involved. On the other hand, smart contracts enable automated payments systems and help solidify the validation of transactions. As one can evaluate from the above-mentioned scenarios, the integration of Blockchain in capital markets can fundamentally refashion the capital markets in the coming years.

According to a report, transactions worth approximately $3360 trillion were operated in the year 2020 by various capital market institutions. The year 2021 has already witnessed a massive investment worth $774 million by big fishes of the financial industry, namely, Securitize, HQLA, Fire Blocks, Axoni, and others. The massive investment figures can be attributed to the increasing blockchain adoption in the capital markets.

Challenges in traditional financial systems

Traditional banking systems have been around for ages, and a number of financial institutions still operate on outdated legacy systems. Although the evolution of the internet brought about the fundamental changes in banking systems, it is still bogged down by issues of highly centralized and multi-layered infrastructure, the presence of intermediaries, heavily siloed data, and security breaches. Additionally, the lack of transparency for issues, such as – ascertaining security threats on time, also challenge the sanctity of the system.

Such issues have hindered financial institutions from reaching their full potential and making optimum utilization of resources. However, blockchains present viable solutions to these long-standing problems. Therefore, along with massive investments, hope sustains in the capital markets and finance sector.

Use cases of Blockchain in capital markets

- Reconciliation of data

In the current scenario, data is highly fragmented with numerous replications where every participant in the financial chain has their own way of interpreting and storing data. Such a situation leads to instances of data silos within the same department. For instance, a broker, dealer, or an issuer will have to reconcile data stored by the front office, back office, and other multiple sources to get a clear picture of the current status. Furthermore, this data can be manipulated, altered, or worse, deleted.

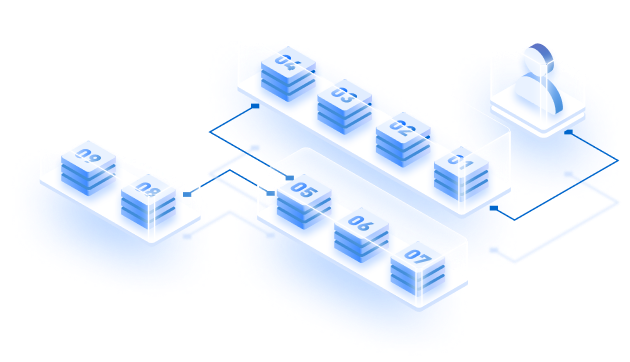

In comparison, Blockchain is structured in a way where every participating node will carry and store the same set of data that is validated through consensus mechanisms. The data stored is immutable and transparent, thus establishing the trust factor among various participants. Moreover, there is no need to reconcile data, which can prove to be a costly process. Most importantly, Blockchain removes intermediaries from the setup, facilitating real-time data exchange leading to speedy settlements.

- Speedy settlements cycles

Blockchain immutability plays a key role in faster settlements as a block, once validated, cannot be changed. The validated block embedded into the distributed ledger database aids the speedy deposit of the associated token (a digital asset) into the receiver’s wallet. The quick settlement process ultimately reduces the associated risks and lowers the settlement costs. For instance, Blockchain can decrease the cash equity settlement cycle from T+3 to T+1.

- Managing collaterals

In the financial world, Collateral management is a process that helps in reducing credit risks in lieu of unsecured transactions between two parties. Financial institutions are ridden with complex issues due to new and stringent regulations, highly siloed infrastructure, and inefficient systems. Also, capital markets are looking for robust alternatives that keep risks at the minimum, remove unrequired intermediaries, increase efficiency, and resultantly evolve collateral management. The solution is induction of smart contracts that interact with the current collateral system to track asset movement, issue margin calls, trigger predetermined rules, etc. A consensus mechanism could help establish trust, thereby doing away with third-party intervention, leading to cost reduction of collaterals. Furthermore, existing collateral environments that are still marred by manual errors, risk factors, and inefficient back-end operations resulting in slow settlements, can hugely benefit from incorporating Blockchain. Additionally, ledger technology could track end-to-end collateral cycles with records of every transaction.

- Audits and Regulations

A blockchain network can be designed in a manner where every node has a specific designation or participating role. For instance, there can be executing nodes to execute a change in block, validating nodes that validate the proposed change, and regulatory nodes or auditory nodes with view-only permissions. The auditory nodes keep an audit trail on the ledger-based activities that cannot be altered or manipulated. Auditing via blockchains gives no room for manufactured inconsistencies and allows users to access the previously added immutable records for reference purposes. Maintaining auditory nodes also are time and cost savior.

All the records are evenly stored on distributed ledgers with all participating nodes while maintaining a single version of the truth. Regulators of blockchains have real-time access to all records and the ability to keep an eye on all the activities happening over Blockchain and allowing them to underpin any malicious attempt or activity.

- AML/KYC checks

In the current system, where it is difficult to keep stringent anti-money-laundering (AML) and Know-your-customer (KYC) checks, blockchains provide a streamlined way to get new participants on board and keep regulated versions of records without resorting to lengthy, complex and time-consuming reconciliation and verification process.

- Tokenization

Blockchain enables the creation of digital assets that represent existing traditional securities, both tangible and intangible in nature. These digitized versions can either represent assets like equities, cash equivalents, bonds, commodities, derivatives, etc., or one can create a completely new line of tokenized investment assets. Additionally, the issuers get faster access to programmable securities. Other advantages are heightened efficiency thanks to high speed and automation, increased liquidity, trading of non-liquid assets, faster and effortless settlements and clearance and reconciliation processes. Furthermore, tokenization allows the concept of fractional ownership to get increased investments and include more players in the issuance gambit.

- Settlements and Clearance

Clearing refers to the steps taken to execute settlements such as recording transactions and posting margins. At the same time, settlement is the actual exchange process of securities. Both are post-trade activities, and according to DTCC (depository trust and clearing corporation), a US-based post-trade clearing house, even marginal trade failure can lead to high incurred costs. These costs can be attributed to the process of manual validations, penalties, addressing claims, and cancellations. When the same company conducted an audience poll during a blockchain symposium in 2016, asking which blockchain use case should be the finance industry’s highest priority, the majority of people voted for settlement and clearance purposes.

Through smart contracts, blockchains ensure time-saving and cost-efficient execution of clearing and settlement processes. The majority of the operational costs pertain to back and front-end offices, investigation process, clearances and settlements. Blockchains can reduce costs by omitting reconciliation and unnecessary verifications and also by storing reference data on shared distributed ledgers.

- Stock exchange

Stock exchanges worldwide have either incorporated or are looking to adopt blockchain technology for cost reduction and speedy settlement. Let us understand more through the examples where major exchanges from around the world have used DLT to strengthen their operational infrastructure.

Other goals of adopting Blockchain is ultimately doing away with clearinghouses, the time-consuming paperwork, and manual auditing, leading to insta settlements and cost-effectiveness.

In 2017, ASX (Australian Stock Exchange) integrated Blockchain that replaced CHESS (Clearing House Electronic Subregister System). The DLT solutions allow both sellers and buyers to confirm transactions through the P2P network. On the other hand, brokers can keep track of participating members while maintaining a time-stamped record of transactions, total securities sold, their prices, etc. The idea is to execute settlements on Blockchain, facilitating p2p exchange. The goal is to cut down third-party involvement, reduce settlement time, and eliminate functional ineptness.

Since DLT’s integration in 2015 by Nasdaq, they have gone a step further with this cutting-edge technology. Linq, a blockchain-based trading platform introduced and launched by Nasdaq, allows companies to trade shares even before venturing into the public domain.

Joining the bandwagon, the National stock exchange (NSE) has also introduced a platform called NSE Shine. Developed in collaboration with a Bengaluru-based startup, it is the platform for gold bullion. It provides a blockchain-based framework to settle gold derivative contracts. It facilitates the creation of a bullion bar repository based on NRS-approved standards.

- DSO – Digital security offering: Financial democratization about time and geographical constraints

One of the most talked-about and conventional use cases of Blockchain is the deployment of DSO, also known as, Digital security offerings. DSO is a digital representation of equity and securities that can be traded online and their record stored on the distributed ledger. Capital markets, especially the exchanges, are constrained by time and geographical factors. Take the example of stock exchanges that remain closed more than they stay open and are also restricted by the opening and closing bell phenomenon.

Moreover, a person sitting in China cannot trade in LSE, or a trader in India cannot trade on NSE. Think of a scenario when the stock exchanges worldwide get consolidated as one entity which are 24*7 operational. Any investor from whichever part of the world would be able to access and invest in stocks and derivatives from any stock exchange of his choice. Assuming this structure becomes a reality, DSO can widen the gambit and breach the time and geographical disparities to mobilize liquidity in global markets. The new infrastructure of security trading offering digital securities and the ability of investors to invest in DSOs, lest they pass AML/KYC checks, can hugely benefit from blockchain integration. This will be the true democratization of capital markets that goes beyond the time and geographical constraints.

Challenges of integrating Blockchain into capital markets

Although Blockchain has many benefits with its distinctive characteristics, its implementation in capital markets can unlock many use cases. Yet its integration isn’t a piece of cake or an overnight process. There are many issues that need to be factored in for a complete implementation of Blockchain in capital markets, some of which have been discussed below.

Irreversibility: Once a transaction is recorded upon a distributed ledger database, it becomes immortal. Especially if a particular validation needs to be corrected, the only way is to add another block as per the required validation. There is no way to make amends or edit the history of the database. This particular functionality may work for value incrementation, but it may cause hurdles when it comes to trade validation as the DLT ecosystem runs on compliance between nodes.

Scalability: Scaling up the transaction speed has been an ongoing problem with permissionless or public blockchains. Ethereum classic is a prime example of scalability issues. Although steps have been taken to increase the volume of transactions within a certain time limit, it is still a slow and lengthy process. For instance, in the case of Ethereum, a new protocol is being developed called Ethereum 2.0, which is currently up and running on the testnet. With the entry of permissioned blockchains, many finance-related projects are being either prototyped or already functioning. A Swiss-based fintech company, Instimach Global, has developed a DLT project on R3 Corda to consolidate unsecured money markets, FX, and repo rates. Their primary objective in choosing Corda was to ensure high scalability along with other advantages.

Privacy: Again, permissionless blockchains are dealing with issues like privacy as they are open-source platforms with every transaction for everyone to see. However, permission and consortium protocols solve privacy problems with restricted access and the right to transact.

Need for new regulations: Blockchains are decentralized in nature, which means no central authority monitors these platforms. However, with the widespread implementation and introduction of many blockchain-based projects, some sort of regulatory terms and restrictions need to be in place to ensure better security and privacy. Therefore governments have either set up or are in the process of introducing regulatory measures for blockchain-based activities. SEC ( security and exchange commissions) have introduced several regulatory terms to safeguard investors’ interests, especially when it comes to the financial sector.

Compliance with existing regulations: It is indeed a challenge to integrate blockchain systems with existing regulatory models. For example, in post-trade trading, the implementation of Blockchain can be streamlined only when there is compliance with traditional regulatory bodies like banks, CSD (central securities depositories), and CCP (central counterparty clearing). Incorporating and using blockchains with the regulations in question will neither be an easy task nor will this collaboration happen instantly.

To conclude:

Although in their nascent stage, blockchain has managed to capture the long time interest of various industrial and service sectors. The extensive integration of DLT on a global level can be gauged from the number of upcoming blockchains projects and many already in operation. Although technological overhauls are time taking and an expensive process, one cannot deny the industry’s interest as they perceive this exercise as beneficial in the long run. The capital markets may not have fully embraced blockchains yet. Still, it’s yet to be seen how the full potential of blockchains unravels and how fast and efficiently the financial institutions and legacy systems embody the acclaimed distributed ledger technology.

Zeeve understands the importance of blockchain in capital markets. Our team works diligently to identify and incorporate best possible blockchain solutions in the fintech sector. Get in touch with our team to know more about our services and learn how we turn on the tables for your organization.