Blockchain technology could resolve the challenges and later the inefficiencies that are prevalent in the existing regulatory KYC processes.

The introduction and rapid advancement of innovative technologies such as the blockchain and Artificial Intelligence (AI) have thrown up many lucrative possibilities for vital sectors of the economies to streamline efficiencies and resolve critical challenges. Technology has become a great enabler- empowering the key industries to reduce costs and automate their processes. It is simply not a technology that underlies Bitcoin and other virtual currencies but there is much more than that, especially when it comes to disrupting and modernizing digital identities. There are several applications of blockchains and among them, the use case of digital identity, Know-Your-Customer (KYC), and Anti-money Laundering (AML) are potential Blockchain use cases worth studying.

In this blog piece, we would attempt to look at how the implementation of blockchain technology could resolve the challenges and later the inefficiencies that are prevalent in the existing regulatory KYC processes.

What is digital identity – KYC/AML?

In a world characterized by increased regulation and with an enhanced focus on monitoring frauds; Know Your Customer or KYC has become a key regulatory requirement for protecting today’s global economy. This process is helpful for banks and financial institutions to acquire relevant information related to the identity and address of their services and products.

Why do we need KYC?

KYC being a regulator governed process pertains to achieving due diligence for authenticating the true identity of customers. It is one of the core processes for all financial bodies and banks to follow stringent rules, without fail to ensure that the banking services are not being misused. Almost all financial organizations, including the banks, are required to perform and complete the KYC procedure for account opening and other critical as well as basic functionalities. The KYC details of all their clients are also needed to be updated by banks periodically to ensure no discrepancies. KYC may be a lengthy, time-taking process involving a lot of manual effort but it is the key cornerstone without the completion of which no banks and financial organization can work efficiently.

The use case of blockchain in KYC and AML will allow banks to provide improved compliance outcomes, enhance efficiency and also deliver satisfactory customer experiences.

Existing problems and deficiencies with KYC

Although the KYC is a critical regulatory requirement, the existing processes pertaining to it are ineffectual and old-fashioned. Financial organizations and banks worldwide are required to keep a constant tab on their customer identities in order to ensure compliance with the regulatory norms. Failure to maintain a verified customer user base can land them up in big trouble and they may also have to pay huge fines for their failure to conform to existing rules.

Sometimes, banks and financial bodies also have to face stiff challenges while navigating between different regulatory bodies, and also storing and protecting huge swathes of sensitive customer data can pose a serious risk. Moreover, collecting the relevant KYC data and verifying client-related details may unnecessarily get duplicated by multiple institutions. The activities pertaining to tracing and verifying their customer identities prove to be highly time-consuming and costly.

Current challenges with tracking money laundering

The financial institutions and banking systems across the world face the serious challenge of money laundering. Even though the cryptos are lucrative and facilitate rapid global transactions, it also becomes a hotspot for fraudulent activities, cyber thefts such as terrorist funding, and money laundering.

Regulatory bodies worldwide are aware of these challenges and are working towards tracking and also curbing such criminal activities through the implementation of blockchain technology in alliance with stringent anti-money laundering (AML) legislation and KYC processes. The effective deployment of blockchain applications is being explored by banks and financial institutions to prevent theft, money laundering through custodian services and crypto exchanges. There are also no fool-proof AML programs that would include KYC processes with no loopholes needed for the identification and verification of users. However, the advent of blockchain and its integration in critical ecosystems and finances provide a ray of hope to everyone involved to uproot the criminal activities in the crypto space.

Unfortunately, the crypto exchanges and wallet providers may also have to suffer the consequences of costly onboarding, interspersed with resistance when performing the KYC process. This could also make them highly vulnerable to data breaches. Therefore, the non-scalability of KYC processes will not help strong financial ecosystems to sustain in today’s world where regulations are required to be followed stringently and norms are made to curb any loopholes affecting the growth of the financial sector.

Idea behind Integrating Blockchain and KYC

Customer verification is one of the most important steps for the smooth functioning of any system, and it’s particularly of great significance for financial institutions and banks. KYC protocol is the key element for banks to know their clients and customers they are engaged with doing business. KYC process involves lengthy, comprehensive practices, where clients submit certain documents and a few background checks and verification steps are followed.

Thankfully, blockchain integration works best to improve the existing KYC process. The revolutionary technology can provide identity verification solutions, thus facilitating automated KYC for more economical, fully compliant, and faster on-boarding of clients.

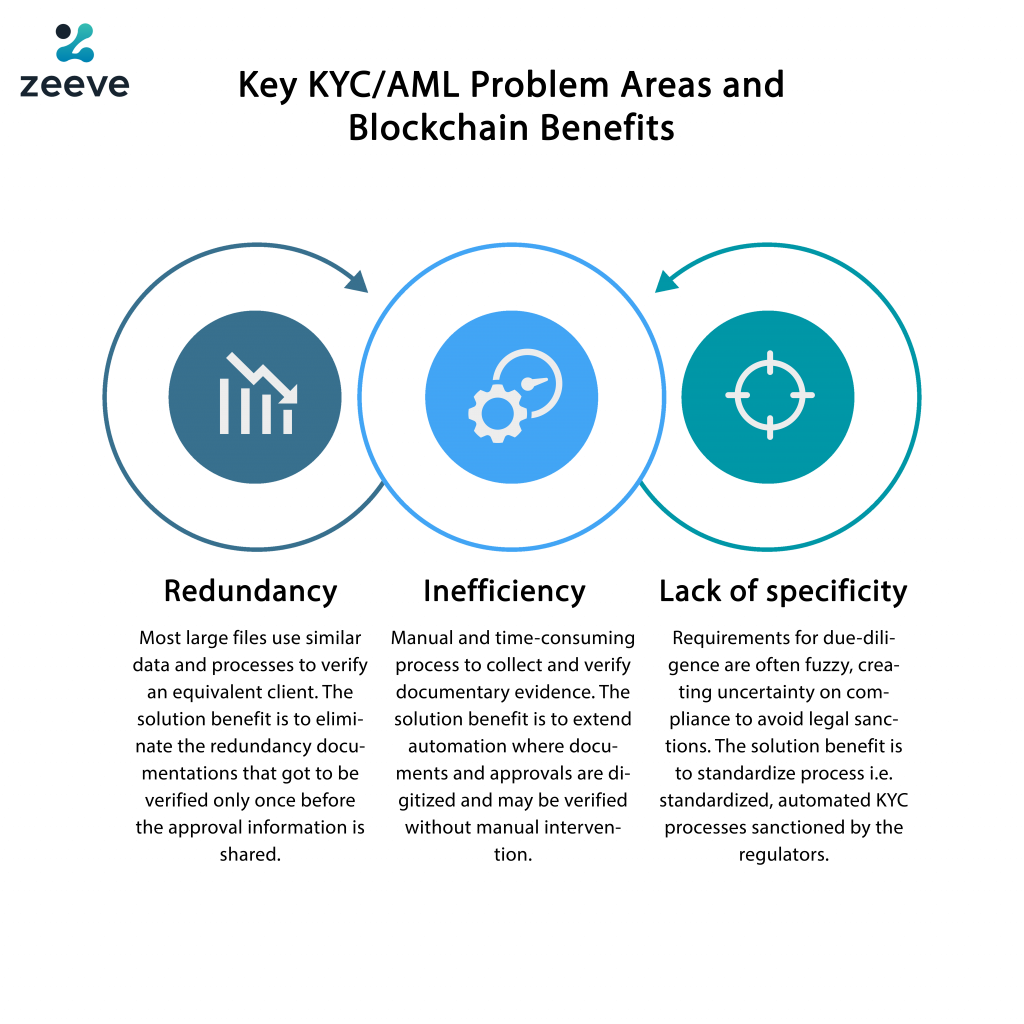

Key KYC/AML problem areas where Blockchain could support

Embracing blockchain technology can bring down the costs associated with the AML/KYC processes. The technology can help with the customer detail verification capabilities across the institutions and also effectively monitors and analyses the data much needed for background checks KYC and AML. Here is a look at some of the key problem areas of KYC/AML and how the blockchain deployment could resolve these problems:

Problem 1: Redundancy:

Almost all banks ask for similar background verification files, checks, and also data to verify their clients.

Solution

The key benefit of blockchain implementation to KYC/AML processes would be to eliminate the redundancy by seeking the same type of documentation. All documents need to be substantiated just once right before the approval information is shared.

Problem 2: Inefficiency

KYC processes are inefficient as they require manual effort and turn out to be extremely time-consuming for financial bodies to collect and verify documents. Often on-boarding the large corporate clients and customers can take several days given there are multiple checks and with many pieces of documentation required to be produced and verified.

Solution

The automated processes of blockchain technology ensure that the documentation process and approvals are taken place digitally. All the documents are to be verified without any kind of manual intervention.

Problem 3: Lack of specificity

The due diligence standards of all financial institutions vary and hence the requirements for performing due diligence also vary. However, sometimes many financial organizations are uncertain and this ends up creating ambiguity on compliance.

Solution:

Blockchain can benefit by standardizing processes and also automating the KYC procedures as approved by the regulators. With the application of blockchain in digital identity (KYC/AML), the immutability of the distributed ledger would facilitate the best opportunity for regulators to have nodes on the blockchain networks, back the ability to provide a complete, transparent audit trail of all the transactions.

Problem 4: Expensive

Conducting the KYC process is just not time-consuming but also a huge cost burden for the banks as it is a non-revenue generating for the non-discriminating processes. Besides, there are also hefty fines for inaccurate discharge of KYC duties. Even handling the AML operations and checks require bigger teams and mostly these lead to huge costs and inefficiencies.

Solution:

The use of blockchain in logistics can lower down the operational costs for financial organizations and banks as it will not require performing the KYC-check for every customer once they have conducted the checks and sanctioned the digital identity. Moreover, the blockchain application can also imply having fewer active staff as needed for dealing with the false positives.

Problem 5: Deliver a poor customer experience

KYC processes are painful for the clients with multiple documentations and lack of collaborations with KYC utilities can result in a fragmented market.

Solution:

Integration of blockchain with the KYC process can facilitate quicker account openings while also cutting down friction, delivering optimum benefits that can be realized by banks and all financial institutions. Blockchain use cases in KYC deliver a better customer experience as the customers do not have to submit the documentation multiple times. The same digital identity could be used across multiple sectors and not only for financial transactions.

Problem 6: Security and cyber theft

The biggest challenge with the existing ecosystems is that there are major security concerns over the safety and security of data collected for the purpose of digital identity. Anyone could breach confidentiality and cyber hackers could also use sensitive data for indulging in fraudulent activities.

Solution:

Blockchain use case in digital identity provides enhanced security, ensuring that there is an instant real-time sharing of updated KYC documents, validated digital identities. This would also prevent any occurrence of fraudulent transactions.

Difficulties with blockchains in upgrading KYC/AML processes

Although the application of blockchain in the digital identity space (KYC/AML) is tremendous, there are quite a few hurdles too that businesses need to face. Here are some:

Privacy – Not every corporate entity would want the banks or indeed their customers to look through the KYC documents/AML data, especially if they do not have any relationship with them. Even if they have a relationship, when the corporate entities would break away from a relationship with a bank, they would also like their data to be deleted and “out-of-reach” so the big question that arises is if the blockchain technology would be able to manage this.

Standardization – It is easy to achieve standardization as the banks in the same jurisdiction are needed to conform to the KYC norms. Nevertheless, there are a few challenges where enhanced standardization would only extend the benefits of using the blockchain in KYC processes. In the first place, it would bring a cross-jurisdictional adjustment of KYC requirements across diverse regional and national regulators. Also, it would also standardize the bank’s own on-boarding authorizations concerning their own risk appetite and customer profiling.

Liability – In the case of the bank verifying and validating the digital identity and it being used by another bank, who in that case would be held liable for a fraudulent transaction by that customer. Customer data should be verified how frequently and who should be accountable for re-verification.

Single Point of Failure – does the creation of a single global KYC / identity blockchain create a target for hackers and cyber-terrorists?

Final thoughts

With the potential of blockchain technology for KYC, digital identities, and AML still largely untapped it is important that market participants work together to find solutions that will allow them all to focus on their customers. Blockchain technology has immense potential for KYC, digital identities, and AML to be a successful proposition with challenges that need addressing in order to make it so. The power of this tech is driven by the network effect which can only occur when market participants work together towards a mutually beneficial solution; collaboration amongst all parties will allow them to focus on customers’ needs instead

A great use-case would thus lead us down an exciting new path forward where we may finally see these problems resolved!

Zeeve blockchain deployment

Rely on the best blockchain experts to ensure that the blockchain use in KYC/AML processing challenges is resolved with utmost success. Our experts can help customers get the best advantages by working out ways to integrate advanced blockchain solutions to create digital identities and deliver easy solutions for complex problems. At the core of our blockchain deployment efforts is to provide our clients with better transparency, improved productivity, high-grade security, and also freedom from third-party intermediaries.