Arbitrum isn’t just growing — it’s compounding itself. Over 1,800 real developers (no bots) have pushed more than 7,400 commits across 100+ repos since 2023, fueling a surge in network traction. At the same time, Arbitrum’s TVL has also jumped from $1B to over $3B as per DeFilama. If these numbers aren’t sufficient to prove that Arbitrium is making headlines and a battle-tested chain, it is hard to say what would be.

If you’re tracking real fundamentals, few chains have proven themselves as battle-ready as Arbitrum. But it is not just the activities keeping project owners on the edge of their seats, but the customization guaranteed through a suite of products, like Arbitrum Nova, One, and Arbitrum Orbit, making Arbitrum relevant as per the changing times.

In this piece, we shall see why there was a need to introduce these different offerings and how they solved some of the major pain points of the projects, and which could be the Best Arbitrum Chain for your custom needs. Subsequently, we will also see their present traction due to these benefits at the time of writing.

Top Arbitrum Solutions and Their Relevance For Different Projects

- Arbitrum Nova

Arbitrum Nova processed more transactions today than Ethereum and every other L2.

— Steven Goldfeder (@sgoldfed) February 16, 2024

Yes you read that correctly…

Arbitrum *Nova*, the chain focused on gaming and social.

Gaming on Arbitrum is going 📈. pic.twitter.com/En1dwNH2Bi

That’s a tweet from Steven Goldfeder of Arbitrum in Early 2024, when Nova passed Ethereum in terms of transaction count.

Arbitrum Nova was built for speed — a purpose-specific chain optimized for ultra-low fees and high throughput. It uses the AnyTrust model, a variant of Arbitrum Nitro, where data is posted to a Data Availability Committee (DAC) instead of Ethereum L1. This drastically cuts costs for use cases that don’t require full L1-grade security.

It’s assumed that at least one DAC member is honest and available. If even one of them is online and acting honestly, your data is safe and can be recovered.

That tradeoff makes Nova ideal for apps where value isn’t constantly at risk, like social platforms or large-scale multiplayer games. Instead of following the one-size-fits-all blueprint of full decentralization, Nova strips down the stack to prioritize performance and affordability.

Arbitrum Nova and When It Becomes Relevant?

Gaming and social applications have to handle thousands of transactions per second. So, they need the following:

- Super scalability for massive multiplayer games or high-volume user interactions on social platforms

- Ultra-low latency and high throughput

- Minimal or near-zero transaction fees

While launching on other Arbitrum chains — where all data is posted onchain or settled via Ethereum L1 as the data availability layer — these levels of performance are hard to achieve. But with Nova, project owners can expect transaction costs to drop to under a cent, compared to ~$0.20 on Arbitrum One. In terms of throughput, Nova can reach ~100–200+ TPS, whereas Arbitrum One typically clocks ~20–40 TPS.

With these trade-offs, it’s no surprise that game development is picking up on Nova as its best Arbitrum Chain. Apart from gaming, here are a few more use cases:

- Social dApps and message-heavy apps.

- Event ticketing or loyalty systems.

- Other high-frequency onchain activity.

But, you too have to settle for some drawbacks, nonetheless, at the same time, while choosing Nova for your gaming and social platforms, because;

Ecosystem Activity of Nova

Nova currently holds a modest TVL of around $25M, according to L2Beat. As a result, projects like ARBSwap, RCPSwap, and Slingshot have had to manage liquidity provisioning on their own, often bootstrapping ecosystems without the depth or DeFi composability seen on Arbitrum One. Activity remains limited, and liquidity constraints continue to be a challenge for apps that rely on larger pools or active token markets. A complete list of projects on Arbitrum Nova can be available here.

1/ @arbitrum didn't just scaled over the years.

— Cheeezzyyyy (@0xCheeezzyyyy) June 19, 2025

It’s entering a unique phase of ecosystem discovery, playing a game few can.

This evolution redefines the boundaries of adoption:

DeFi-native → Institutional Penetration → (Nascent Signs) TradFi Distribution

Insights🧵 pic.twitter.com/fVMVzVWxHy

Unlike Arbitrum Nova, which is optimized for speed and scale in specific use cases, Arbitrum One takes a broader approach. It enables

general-purpose scaling with full EVM compatibility, high throughput, and Ethereum-standard security. That combination makes it ideal for building and scaling complex applications like lending platforms, DEXs, vaults, yield strategies, DAO infrastructure, and institutional-grade DeFi. There is $7B of Stablecoins on Arbitrum One, making it the largest L2 for stablecoins.

$7 Billion of Stablecoins on @arbitrum

— growthepie 🥧📏 (@growthepie_eth) June 19, 2025

– Up 27% in 30 days

– Up 75% from this time last year

– The largest Layer 2 for Stablecoins pic.twitter.com/3xpqHDIGzx

In other words, Arbitrum One is purpose-built for projects that demand both performance and trust, making it the best Arbitrum Chain for such requirements.

Arbitrum One and Its Relevance For Advanced Use Cases

DeFi protocols, institutional finance platforms, DAO frameworks, on-chain funds, and NFT marketplaces with embedded financial logic — all of these require a foundation that offers:

- Ethereum-level security and trust assumptions

- Complex smart contract support

- Deep composability across DeFi

- Access to large liquidity pools

- Public infrastructure with transparent, auditable data

These apps serve users who demand performance, security, and interoperability, without compromising on decentralization. That’s exactly where Arbitrum One delivers. It remains the top-performing rollup for high-stakes use cases, offering 24*7/365 days liveness, fast finality, and industry-leading cost-efficiency — all while staying deeply aligned with Ethereum standards. As of now, it continues to lead on metrics like TVL and app count, according to L2Beat.

That’s why it is a go-to stack because Arbitrum One is building the next-gen DeFi App

Ecosystem Activity of Arbitrium One

The Arbitrum One Ecosystem is huge. Over 40 AI Projects, 16 GameFi, 10 DePIN, 70+ DEXes, over 68 Bridge infra providers, 23 payment platforms, and a lot more.

The total TVS is a whopping 14.56B, which is what you get when you have more than 700+ applications across diverse segments, building on top of a layer.

- Arbitrum Orbit

We saw how Nova could help manage very high speeds suitable for gaming. Still, by diluting decentralization a little in the process, at the same time, we also saw how Arbitrum One helped in meeting the middle ground between decentralization and scalability for general-purpose scaling. Still, no solution dares speak of an absolute level of customization. That’s where the role of Arbitrum Orbit begins.

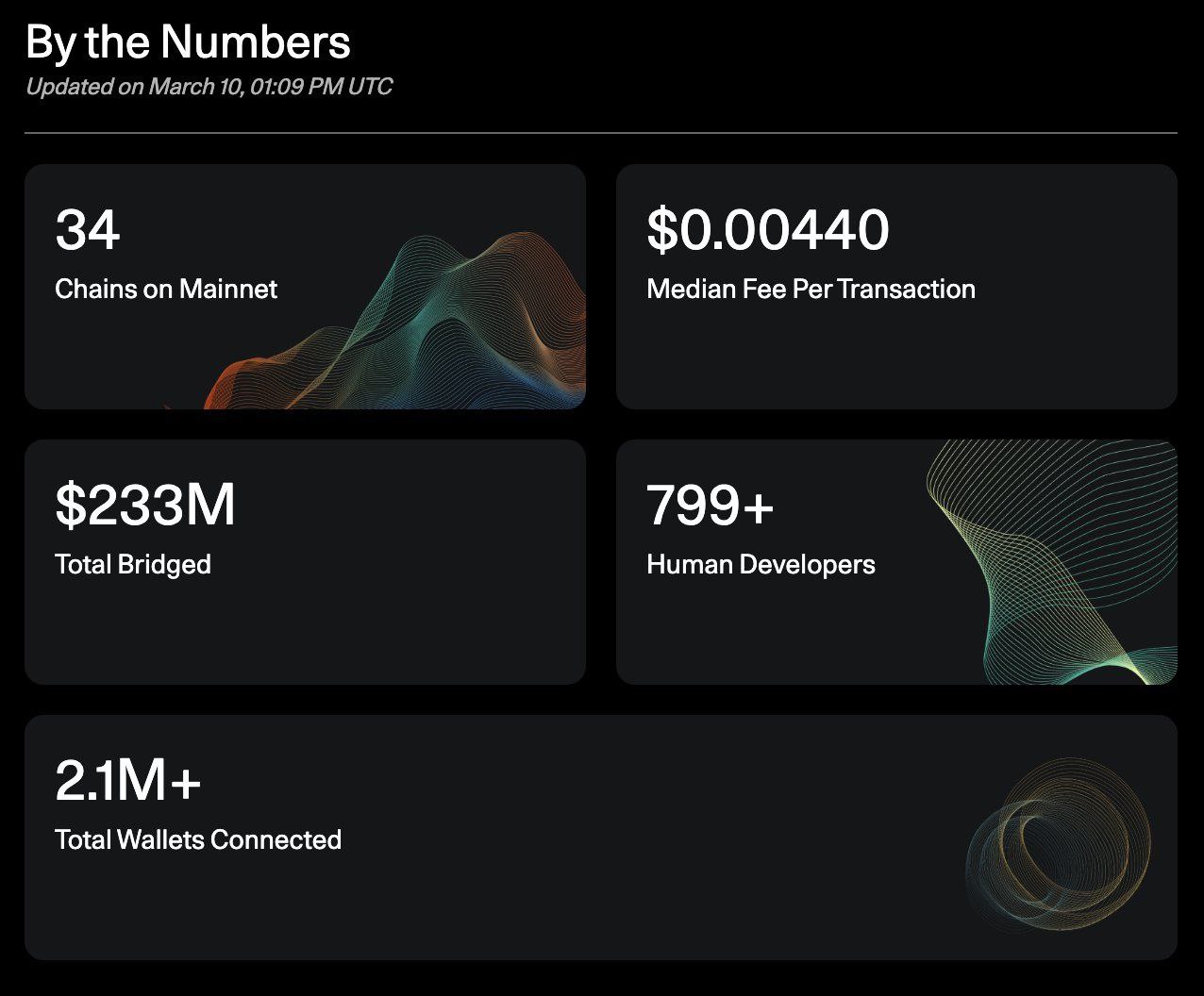

Here are some stats to start with

- 30+ Orbit chains have already hit the mainnet.

- $200M+ Total Value Locked (TVL).

- Rapid ecosystem expansion, with more projects deploying soon.

Arbitrum Orbit and How It Turns Relevant?

From DeFi to NFTs to gaming and more, Arbitrum Nova and Arbitrum One fail to catch up with the project requirements when the following specs are in demand;

- Dedicated resource

- In-app economy control

- Regulatory business requirements

- modular upgrade

- custom governance

- brand identity and interoperability

But Arbitrum Orbit delivers from the front because it allows any project to optimize as per its project dynamics, making it the best Arbitrum chain when customization from the ground up, that’s what you are seeking. So, with Orbit, you can upgrade your execution logic for your application, like you want to compute the transaction validation mechanism, or you want to engineer where the smart contracts will be running, or the way gas fees are calculated, or state changes are applied. For all of that hard baked into your application, like in gaming, NFTs, and DeFi apps, Orbit leaves no stone unturned. The Arbitrum Foundation claims that Orbit is improving the scale of compliance and scalability.

Arbitrum Orbit continues to enhance customization, empowering projects to tailor their solutions to specific requirements!💙

— Arbitrum (@arbitrum) January 18, 2024

Today, we introduce an Arbitrum Orbit Expansion Program, allowing you to have a self-service path to launch custom Orbit chains (L2s or L3s) that settle… pic.twitter.com/yAibMPN7hC

With that said, how the ecosystem activity of Orbit chains progressed is something worth looking at.

Ecosystem Activity of Arbitrum Orbit

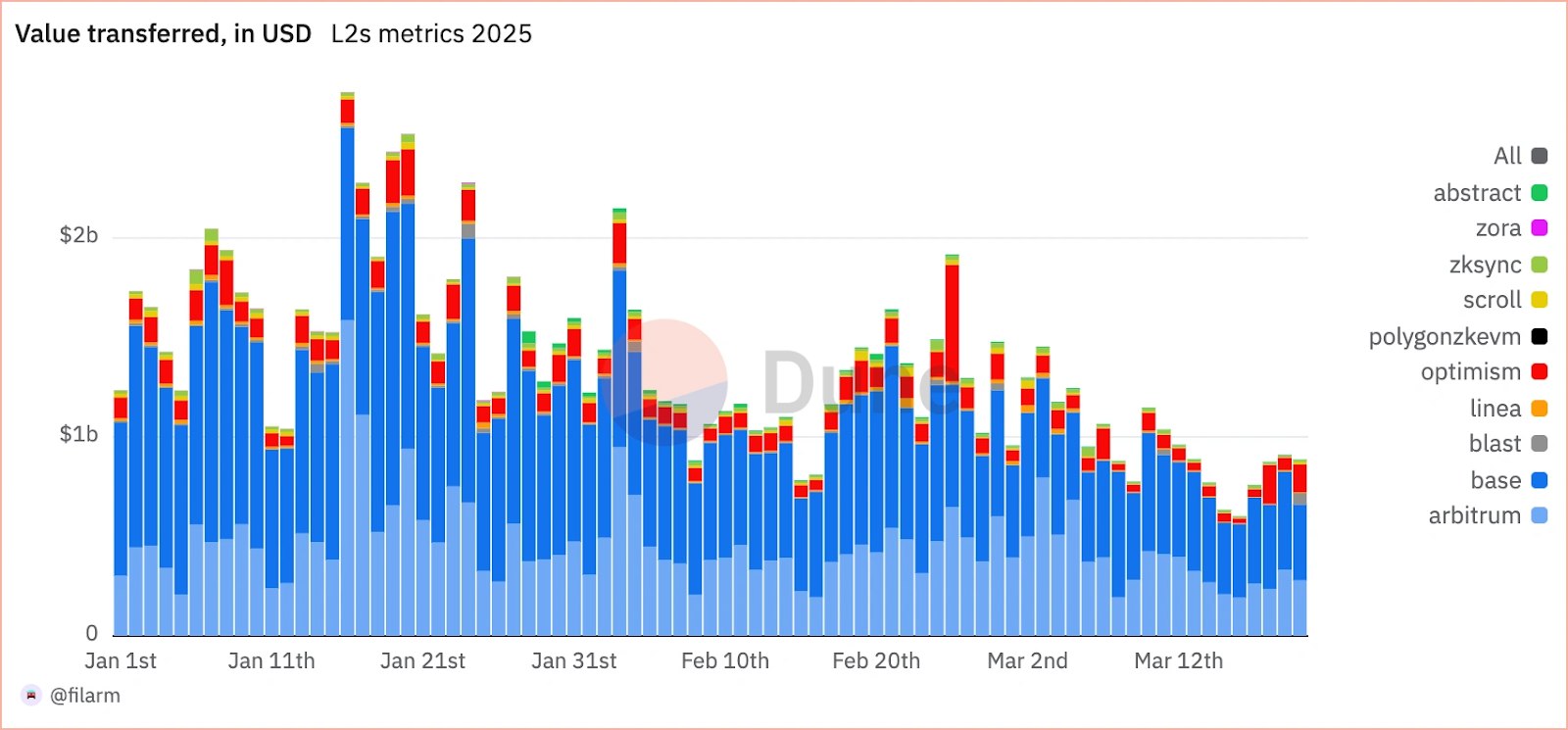

At the moment, Orbit is leading from the front in the ecosystem with the majority of the TVL, even outsmarting Base as per the chart below.

Some of the top projects are being developed on Orbit as per the image given below, showing peak development activity at the moment and in the near future. With a growing, robust system, Orbit could end up as the best Arbitrum chain, but we shall have to wait and see for that.

So, what should be your preference after going through all of these?

What to Choose? Arbitrum Orbit, Nova, or One?

Choosing the best Arbitrum chain will entirely depend upon what you intend to achieve because there’s no one-size-fits-all solution. So, here’s how you can proceed with it.

Choose Arbitrum Nova if:

- Your project needs ultra-low fees and high throughput.

- You’re building social platforms or massively multiplayer games with lightweight transactions.

- You can work around limited liquidity and are okay with modest decentralization trade-offs.

- You don’t require deep customizability in execution or governance.

Best for: Fast games, social dApps, loyalty apps

Fee: Extremely low (cents)

Customization: Low

Liquidity: Low to moderate

Examples: Early-stage gaming & social apps

Choose Arbitrum One if:

- You want general-purpose EVM compatibility with Ethereum-level security.

- Your app depends on deep liquidity, DeFi composability, or complex smart contracts.

- You’re in institutional finance, DeFi, NFTs, or DAO infrastructure.

- You require high availability, auditability, and a mature ecosystem.

Best for: DeFi protocols, DAOs, on-chain funds, institutional-grade dApps

Fee: Moderate (~$0.20 per tx)

Customization: Limited (EVM-based)

Liquidity: High

Examples: Uniswap, GMX, Aave, Radiant, XAI

Choose Arbitrum Orbit if:

- You need a dedicated rollup or L3 chain with full control over your environment.

- You want to upgrade execution logic, customize gas tokens, or build unique governance models.

- Your app has regulatory needs, requires in-app economies, or demands sovereign branding.

- You want to build appchains or rollups under your own rules, while still settling on Arbitrum or Ethereum.

Best for: Custom gaming chains, RWA platforms, compliance-first apps, enterprise-grade solutions

Fee: Configurable (own gas tokens)

Customization: Very high

Liquidity: Depends on design

Examples: Galactica, custom DeFi/NFT/gaming chains

TL; DR

| Features | Arbitrum Nova | Arbitrum One | Arbitrum Orbit |

| Use cases | Gaming, Social | DFi, DAo, Infrastructure | Fully Custom Appchains |

| Customization | Low | Medium (EVM Restricted ) | Full (Execution Logic) |

| Fees | Super Low | Moderate | Fully Configurable |

| Ecosystem Activity | Modest | High | On the Rise/ Emerging |

| Liquidity | Low to Moderate | High | Project defined |

| Security Level | Optimized for Speed, a bit low | Ethereum Equivalent | Flexible, based on the project’s needs because you can choose to settle on Nova, One, or Goerli |

Now, if you made it till here, making up your mind for the best Arbitrum Chain, it means you are seriously interested in launching your application, and for that matter, you want expert guidance to ace this stack war to the next level for your application. And that’s where the role of Zeeve begins;

Build Your Arbitrum Chain with Zeeve RaaS

In order to build your own best Arbitrum chain, you do not have to exhaust all your resources. With Zeeve, you get your own sovereign, performant, and customizable chain as per your needs: Be it Orbit, Nova or One.

Zeeve now offers a $50 launch for testnets — ideal for teams exploring Arbitrum Orbit rollups for use cases around AI, gaming, NFTs, RWAs, and more.

With support for AnyTrust mode, Stylus (Rust/C++), and 50+ third-party integrations, Zeeve gives you the tools to design, deploy, and evolve your Orbit chain your way. And when you’re ready to go beyond the testnet, Zeeve’s Rollup Management Console and one-click testnet Sandboxes ensure you’re never more than a click away from production.

Talk to our experts, spin up your testnet, and see for yourself what $50 can unlock for your rollup ambitions. We’re here 24/7 to help you go from idea to execution — faster, cheaper, and fully in control.