Trade finance is the heartbeat of international trade, rendering the finances required for executing deals between buyers and sellers across borders. Most significant concerns pertaining to the liquidity, credit, security of payment and insurance need to be addressed to complete the transaction on terms that would be agreeable to both parties and these can be done with provision of finances for trade. However, the intensive paperwork and documentation can prove to be quite a disadvantage for the trade finance sector.

Nowadays, the economically critical industry of trade finance, which was once a central concern of blockchain technology, has now emerged as a key focus domain in utilizing it to enhance productivity and propel the industry forward. Blockchain technology has gained immense traction as the most innovative technology to revolutionize the global trade industry. By leveraging the blockchain technology, participants in the trade finance domain can resolve some key disputes, including the disputes and fraud, verify the flow of trade assets, and ensure delivery and seizures of trade receivables.

Current landscape of trade finance

In the context of international trading activities, trade finance or the process by which financial institutions are granted a credit card by guaranteeing the security of financial transactions is quite essential. Both parties- buyer and supplier benefit from and utilize this trade finance and its services because with this it is possible to fulfill the delivery, payment, and auction cycle. It also helps close the funding gap and shortens the trade cycle. Both the size and health of the $16 trillion international trade industry depend on the availability of and stability of financing mechanisms. That is why trade finance is sometimes referred to as a driving force for global trade.

However, business participants with a certain set of characteristics may be prone to business risks and failure brought on by several factors, including variability in trade and legislation requirements and fluidity between different regions of the world, as well as operational and logistical difficulties that arise when a large number of parties take part.

Increasing numbers of litigation and fraud as a result of trade financing have been reported in recent surveys by the International Chamber of Commerce. Examples of fraud and trade receivable financing include the $1.1 billion lawsuit against Citigroup due to financing falsified receivables, and the losses of 400 million to several banks due to trade financing fraud.

Pain points of trade financing in today ‘scenario

· Delays in payment to buyers and suppliers due to the process expenditures

· Absence of understanding into the goods movement

· Effort-intensive process for counterparty due diligence and contractual compliance method

Physical paperwork captured, moved, or done between coordinator, regular clients, exporter, importer, import-lender, exporter-lender, shipping company, receiving company, local shippers, liability stapler, liability cultivator, financiers, and more. These constraints of excessive documentation and paperwork frequently present the risks of being quickly outdated, the need for a great deal of time to prepare them, the expense and energy to absorb them, and the potential for their documentation to be manipulated. Paper documents can also be a target of premature obsolescence, forgery, and defacement.

For financial institutions, these obstructions can lead to unfavorable bank credit lines for small businesses. Banks rejected around 60% of the SME applications for trade in 2018. A poll conducted by the Asian Development Bank indicates that unmet demand in trade financing is likely to amount to a whopping $1.6 trillion. International Finance Corp.’s estimate is that businesses worldwide with fewer than 500 employees need $2.6 trillion in capital to fund their operations. It is for these challenges and limitations that have capped the size of the trade finance market, adversely impacting global commerce.

COVID-19 impact on trade financing activities

The impact of the COVID-19 pandemic on financial exchanges and matters connected has altered the process of many trade finance procedures, for example origination and transmission, negotiable documents, authorized signatures, and shipping.

Nowadays, many companies all over the world are attempting to enhance their digital initiatives as they seek to change the way people interact.

Banks are increasingly becoming aware of technology’s potential to streamline the banking industry by innovating into trade finance ecosystems that reduce financial costs and improve trade finance efficacy.

Surveys by the International Chamber of Commerce (ICC) in April 2020 found that depositors will significantly increase the number of payments through blockchain, the digitization of records, and automatizing digitization and handling.

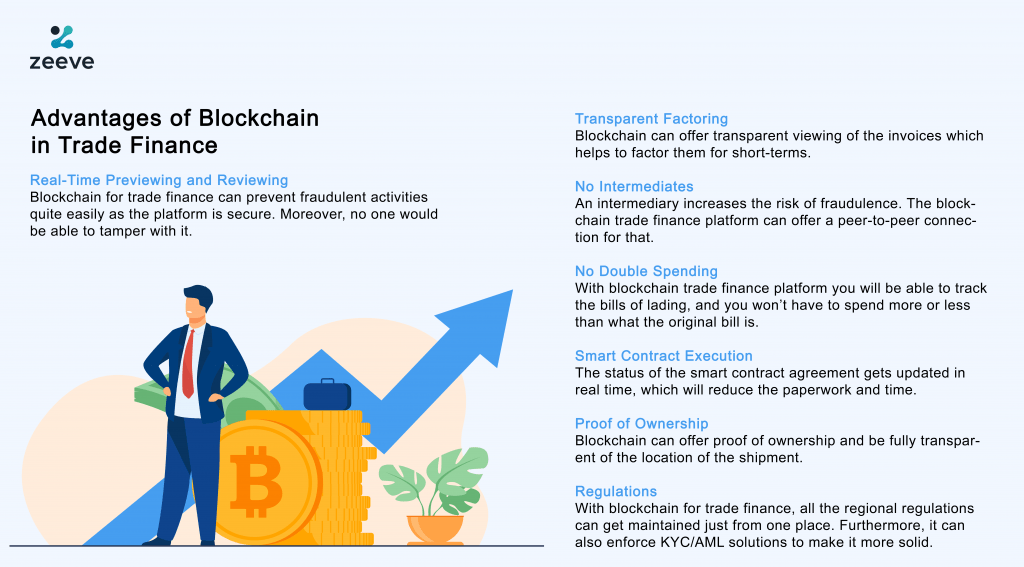

Leveraging blockchain technology advantages for trade finance

Blockchain technology holds the potential to revolutionize business processes by redefining the way goods and services are exchanged and by reducing operational complexity, transaction costs, and profit-extracting intermediaries. Blockchain technology requires a decentralized database that automatically receives a variety of highly efficient data transactions and records them in batches of blocks, with each part secured from tampering and revision. Every block is time stamped and there is a link connecting to an earlier block. The blockchain technology, serves as distributed data storage, including features such as point-to-point communication, consensus mechanisms, and encryption

To confine the power of a single entity, most blockchain networks intend to establish a database system in which decentralized agents or companies together preserve information. The launch of blockchain technology was predicated on the principle of decentralizing data storage so that such a database could not be controlled by a third-party entity.

Blockchain enthusiasts reason that the blockchain network may serve as a database (ledger) for trade finance because of its distributed structure, which maintains detailed records of every transaction among financial stakeholders.

The blockchain might help supply chain transparency and transaction clarity. Trade finance experts believe that transitioning from paper to electronic documents could help minimize the total supply chain costs, enable flawless documentation of transactions, and facilitate fast distribution of bills to customers.

Consequently, banks will earn more income from trade finance activities by attracting companies that don’t actively participate in cross-border trade and companies which choose to switch to documentary credit trades in an effort to seek additional risk management. It won’t be wrong to think that the revolutionary blockchain technology will eventually be able to counter all the weak points of the conventional paper-based trade financing system.

Banks and corporations will be able to reduce the amount of labor required to collect, scan, and re-key data through the digitization of documents, thereby making trade finance more efficient. Also, blockchain technology may enhance an entity’s ability to access documents and satisfy ongoing contractual requirements to resolve disputes over ownership or access to key information.

Smart Contracts in International Trade

The use of smart contracts brought forth by the blockchain technology has been a positive step since it entails contracts executed on the decentralized consensus mechanism. At the same time they cannot be altered since there are unchangeable algorithmic implementations.

The smart contract applies a set of commands for automated control, including meeting terms and conditions agreed beforehand. By means of algorithms for programmable processing, the system can develop and carry out digital terms. Smart contracts can facilitate communication with individuals without trust within them. Smart contracts can be programmed according to the terms of the contractual arrangement, and payments can be processed automatically.

One study indicates that smart contracts can save businesses a lot of time, money, risk assessment, and effort. This can allow for more flexible market-based governance structures within the specified circumstances.

Smart contracts often enhance trust in safe financial transaction data through the security systems and automate the transaction without human misinterpretations or intermediaries. Technology based on smart contracts, therefore, is especially beneficial for trade activities in which the importer and exporter have little – if any- trust.

The storage of sensitive data in smart contracts decreases the risk of data getting falsified, making it possible to save on transaction fees and increase trust between trade partners. Smart contracts, therefore, have had a wide range of applications in the international trade industry. Smart contracts may be used to improve trust among parties with open account transactions, increase transparency, provide enhanced reliability in the information, decrease the risks of fraud or errors, and facilitate the transfer of payments.

Initiatives to apply blockchain technology in trade finance

The development of blockchain technology is still at a nascent stage, and deeper research and investigation is required to integrate its benefits in various applications and to speed up the performance, its productivity and security for various industries. It is for the wide range of benefits that a number of business organizations and start-ups have started working in close collaboration with blockchain as service providers for its wider adoption.

In 2016, Barclays announced that it had launched a partnership worth almost 100,000 USD with a fintech company named Wave to perform the first global transaction using blockchain technology. The trade was completed between an Irish dairy and food supply company named Ornua and Seychelles Trading Company. The company called Wave created this innovative solution for international traders looking into more transparency when performing cross country shipments by providing them all information about each stage in an order’s journey right from picking up goods at dockside until delivery.

In 2018, the blockchain technology garnered more popularity. This year we’ve seen the use of this new form for trade documents by banks all around Europe! In HSBC’s recent transaction with ING Geneva, it issued an entirely digitized letter-of-credit using Blockchain tech–the first time ever such a thing has happened!

This motion concerned the importation of frozen tuna from Mexico. The letter of credit for this project was issued by BBVA. In this project, the blockchain service eliminated paper documentation and signatures to take away cumbersome standard trade documentation.

From January 2020, Standard Chartered and DBS Bank Ltd. disclosed that they have started a project to use a blockchain network to register trade finance transactions with the support of 12 other banks, including ABN Amro, ANZ, CIMB, Deutsche Bank, ICICI, Lloyds, Maybank, Natixis, OCBC, Rabobank, SMBC, and UOB. DBS Bank Ltd and Standard Chartered announced that they would work with SBG to implement Blockchain technology. Standard Chartered agreed with Singapore’s Association of Banks to work together to initialize the trade registry, then expanding it to cover global trade corridors later on.

The blockchain and smart contract technology that IBM pioneered has been at the leading edge of its use in trade finance. In 2017, IBM and Maersk collaborated with Hyperledger Fabric to develop a fully digitized supply chain model that uses blockchain technology and involves trading parties, ports, and customs officials.

Blockchain technology and its applications have also been promoted by a variety of consortiums specializing in the market. Major banking consortia collaborated to create trade finance platforms along with technology providers such as IBM Hyperledger or R3 Corda.

Major financial institutions, such as banking associations, have selected cooperation since digital portals provide a cost-effective and helpful method for customers. The most popular programs for trade finance are we.trade, Marco Polo, Contour, Komgo, India Trade Connect, and eTradeConnect.

Roadblocks in blockchain implementation in trade finance

Although the prime objective is to attain complete digitalization to ease the complications in the trading finance domain, it is likely to take some more time to accomplish that goal. As is observed, though the trade finance industry is realizing the benefits of the adoption of blockchain, it has been a slow process so far. This sluggish implementation of the blockchain technology could be for several reasons. Here are some of the principal causes for the weak adoption of the blockchain technology in the trade finance domain:

1. Absence of standard protocols for blockchain networks

A major problem with the implementation of the digitization in trade finance is the lack of standard blockchain protocol. Most developers try to do things differently and one can see different consensus mechanisms, coding languages and even privacy policies creating disparities that make it difficult to connect with each other. It causes lack of interoperability and also absence of standardization between the different blockchain platforms. Blockchain technology is not owned or controlled by a single business, so it is an important tool with several benefits to the whole market. Developers, technology providers, and other participants should join forces and operate interdependently in order to prevent fragmentation that may limit the use of the blockchain in the trade market and prevent full adoption.

Interoperability and the development of end-to-end solutions often decide the future course of trade data digitization. Hence it is quite critical to develop an ecosystem that allows seamless exchanges of data between existing systems in order to boost the trade digitalization. Consequently, it is also important to set up a global standard protocol for blockchain platforms for the processes to operate seamlessly with each other.

In trading networks in which each actor uses their own particular data to keep a record of their interactions, each transaction will need to be rechecked and re-entered manually at every step of the way. The presence of different centralized systems would lead to the problem of establishment of different localized data centers with no interoperability with each other.

The existing consortiums need to provide paperwork to connect with digital platforms. The different ecosystem participants, including the trading companies, shipping and logistics firms, financing organizations such as banks and also the customs have to be in agreement with a standard set of technology principles and rules for blockchain to achieve its expected set of benefits in trade finance.

Certain initiatives have been taken with the aim of establishing a standardized set of globally accepted digital standards for finance trade, and this incorporates specific areas and continents. A good example of this is the September 2020 launch of the International Chamber of Commerce Digital Standards Initiative by Enterprise Singapore and the Asian Development Bank and the involvement of the World Trade Organization (WTO).

2. Legal Systems need to recognize digital trade documents

There is an imperative need for creating a synchronized regulatory environment that could back the digitalization of trade and strengthen the adoption of blockchain in trade finance. The uncertainty pertaining to the legal status of the electronic documents among the legal systems often pose a serious challenge towards the enhanced adoption of the blockchain across the trade finance industry. Even though a number of jurisdictions unilaterally recognize e-signatures and e-documents for international trades, there are a few jurisdictions that refuse to acknowledge these e-signatures and e-documents.

A report by the ICC banking commission has shown that there are different legislations in different countries for contracts to be created and signed. So far only the United States acknowledges electronic bills of lading as a suitable documentation to meet the same legal standing and respectability as other tangible documents. The report further stated that the nominee bank under a categorical loan may not note an electronic bill of lading, as it can endanger the issuing bank’s right to obtain compensation. As such, the legal standing of the document is dependent on the degree of risk taken by the nominee bank.

Trade blockchain is likely to face concern because of this legal tension between blockchain and traditional paper-based documents. The evolution of regulatory requirements could only help participants realize the true potential of the blockchain technology to facilitate international trade with large-scale deployment.

National government needs to be supported by the international organizations such as the ICC and WTO. This encouraged organizations to adopt the UNCITRAL model law and also streamline services for the digitalization of trade. This may result in the creation of the harmonized model for international trade law that would encourage the electronic digitalization of trade.

3. High blockchain implementation costs

The sheer price of creating and maintaining a blockchain network is seen as a significant barrier to its widespread adoption. Blockchain networks are exerting more demands on the total combined cost of their transactions due to their high speed and cost effectiveness.

Blockchains are very costly because substantial computing power and electricity are required in order to run. Almost all blockchains require all individuals to share complex mathematical equations and verify transactions to protect the network.

Blockchain mining program takes an evolutionary approach in which the fastest miner who records the transaction gets the benefits, as it consumes more energy trying to out-do those miners.

Costs arise from the performance of each device (device) on the same process at the same time as every other apparatus with its very own copy of the information attempting to be the first to solve a matter. Miners often set up automated network servers with a lot of processors to maintain the whole system running, which can cost a great deal of money.

Integrating blockchain with an organization’s information system can be a challenge for many companies. In many instances, choosing to utilize blockchain necessitates restructuring an organization’s information system or devising a method of integrating the two.

Prospective blockchain technology is unlikely to gain much traction among government agencies or private companies with substantial overhead investments.

4. Information Broadcast and Privacy Concerns

Some security problems in the Blockchain’s overall design stem from the necessity for sharing distributed ledgers. The distributed aspect of a Blockchain’s blockchain means that each party that can process and contribute to the structure will have access to the transaction thread and individual components.

The blockchain database will be utilized by members of this network to share shipping files containing bills of lading, letters of credit, and other shipping documents. Accordingly, a blockchain functions as a qualification with open ledger visibility to anyone who detects it, which can create a scenario that creates an unpleasant business atmosphere for several companies.

A component of distributed ledger characteristics must be modified in such a way that it allows access to authorization-only data.

5. Compliance Policies and Procedures

Another issue for blockchain technology is whether it can address the issues posed by financial crime regulations in international trade finance. For banks, in particular, the technology should have the capacity to support compliance regulations.

Concern about financial crime regulations is due to the fact that the blockchain technology lets businesses carry out financial transactions while minimizing the inspection and reporting procedure. When a trader needs to be privy to the shipping details of a purchase, they will need to log into the trading journal, which includes the bills of lading, letters of credit, and other shipping paperwork.

If one is not giving all relevant information regarding sanctions even if prescribable is necessary for commercial reasons, it could possibly expose all the participants involved in the transaction to the sanctions risk. For instance, if the invoice did not list the items to be exported to a sanctioned country, then others processing the transaction would not know that, and the sanction would be incurred.

Banks could be accused of applying insufficient due diligence when they only evaluated the electronically available structured data uploaded by their counterparties, without scrutinizing the underlying documents and the unstructured data.

On the other hand, if a bank chose to cut back on the associated risk by requesting for the required documentation, the problem of the blockchain system would lose its purpose, for example, to disrupt the reliance on conventional documentary trade systems. Therefore, it’s essential for developers of blockchain networks to be in contact with organizations responsible for monitoring sanctions.

Final thoughts

Blockchain-based trade networks have the capacity to benefit all participants across the ecosystem by reducing friction from the operational and organizational inefficiencies located throughout the trade finance value chain. Over the short time, blockchain could be applied to optimize business processes by reducing the utilization of devices and procedures that duplicate or duplicate efforts. Blockchain technology for trade finance would have an exceptionally profound effect over trade and transactions, yet to meet its full potential several hurdles would have to be overcome.

Industries spend a lot of time and money to ensure acceptance and collaboration so they can reach critical mass to drive network efficiencies. Within the blockchain networks, they are also in charge of altering the complexity and operation of operational and environmental management processes.

Blockchain is merely one part of an overall solution, and decentralized applications require careful strategic choices and design scope for implementation. Additional difficulties would be entailed regarding the actual security and legal acceptance of such networks and the challenges of applicability, scalability and reliability. Blockchain adoption will require continued breakout advertising campaigns to promote it and accelerate its introduction to mass use.

Zeeve is a leading blockchain as a service platform with enterprise grade deployment solutions and providing the finest management platform for your Blockchain networks and decentralized applications. It helps in deploying your production decentralized application or PoC in the fastest time possible. Get in touch with our team for node deployment.