After several key industries gained multiple benefits from blockchain technology, another prime segment that is scrambling to test the advantages of this revolutionary technology is Insurance. Blockchain in insurance could make a big impact both for the insurance companies and the policyholders as it can improve competitiveness, execute transactions in a smooth way, manage risks, bolster competitiveness and also integrate the fragmented legacy IT systems.

Blockchain in Insurance Modernizing the Fragmented Pieces

The insurance industry is a significant part of the economy itself. Most people would agree that insurance is critical for businesses as it protects people and businesses from suffering potentially devastating losses. It is a very complex industry with many moving pieces. When technological progress is transforming the business landscape, people demand faster and more individualized customer service.

It is for this reason that the traditional insurance system is quite inefficient and considerably complicated from the customer’s perspective. However, the emergence of blockchain and its application to insurance can resolve the burning issues plaguing the vital segment. Blockchain in insurance can provide solutions to some key challenges faced by the participants in the sector such as increased costs, claim settlements, discerning customers and lack of innovation.

Significance of Blockchain In Insurance

Many insurance companies are unable to supply expected services to customers since they have inadequate information about these people and still depend on a traditional setup. This humongous gap in between this way of providing services for customers and the actual service provision is the main disadvantage from an insurance provider’s perspective. But what many people don’t know is that blockchain technology can make the insurance process more efficient and secure.

So why is blockchain so important for the insurance industry? Blockchain technology can be used to streamline the insurance claims process. Claims can be verified and processed quickly and securely. And because blockchain is a distributed database, it is tamper-proof and incorruptible.

Today with consumers empowered with a few clicks or swipes on their devices, users demand swift services, reliability, economy, and accessibility. Integrating blockchain technology into the insurance sector is of vital importance for the future of the insurance sector. Speeding up the process of integrating and implementing blockchain technology is now crucial.

Insurance companies are also starting to use blockchain technology to issue policies and track premiums. By using blockchain, insurers can reduce processing time and cut costs.

Challenges facing the insurance sector

Being a regulated sector, insurance lags behind others in the context of blockchain technology implementation and it is the presence of regulations that also serves as its major drawback. Besides, the insurance industry is dependent on the inputs from the customers and insights from the public, which often makes it undependable. There is certain another set of limitations that can be improved with the help of blockchain technology:

- Lack of transparency and trust: Often the major complaint of the insurance policy customers is that they fail to determine the rationale behind the differing costs of the policies, the premium rates and also the discrepancies in insurance coverage. Hence, the insurance sector can be quite impervious and it is for this complete lack of transparency that players and participants can have a difficult time tracking and controlling the transactions within the insurance industry.

- Absence of real-time data and analytics: Gathering genuine, highly credible, and real-time data is among the most challenging pain points for most insurance companies. It’s fragmented, different sources don’t communicate and, as a result, as a direct result, the consumer is dissatisfied. Besides these woes, the data is not centered around the customer, which lessens satisfaction. It’s also important to take human factors like human error into account when analyzing data. Therefore, insurance companies are desperately seeking data analysis tools that can provide holistic solutions.

- Lack of automation: The automated system is not fully efficient, causing customers to wait for extended periods before representatives can answer basic questions or resolve their concerns. The absence of standard procedures and processes, as well as inaccurate and insufficient data, affects the performance of employees. Lack of standard procedures, large volumes of claims, customer disputes, underwriting, and agreements outlined for new contracts result in the system’s efficiency being impaired. Widespread miscommunication and provisioning difficulties undermine adequate service performance, leading to customer apprehension and inefficient turnarounds. Hence, factors such as compensating policyholders, describing policies, settling claims, reviewing disputes, conferring on new contracts, and underwriting should be addressed.

- Online insurance frauds and loss of sensitive data: Insurance companies are always under a lot of pressure to keep up with cyber security regulations and prevent any data theft or losses. They live in fear that hackers will steal their data, which can lead them to losing billions of dollars. Claims fraud is believed to be one of the major problem areas for insurance companies. Often ingenuine, fake claims are raised because of the incomplete or misleading data and a complete absence of a transparent system.

The limitations that combine allow us to resolve or significantly reduce many of the problems that this industry has. This is where blockchain technologies could prove to be useful in providing solutions for the problems of the insurance industry.

Use cases of Blockchain in the Insurance Sector

Blockchain computing technology can revolutionize the insurance industry. It’s a decentralized, protected database that stores transactions. Additionally, it provides a way to back up data in a reliable and permanent arrangement. With its decentralized nature, the blockchain technology doesn’t place authority in a single entity hence there is a lack of central authority, and anyone who wants to can add to the blockchain database.

The sensitive data on the decentralized database is tamper-proof and thus cannot be removed or altered and any changes in the data can only be made when all parties agree to do so. This prevents the risk of data breaches, ensures complete transparency, decreases the risks involved, and builds trust. Likewise, Smart Contracts, AI (Artificial intelligence), and IoT (internet of things) are consistent with blockchain to empower the insurance sector. Together, these technologies have the ability to revitalize and revitalize how companies think about insurance.

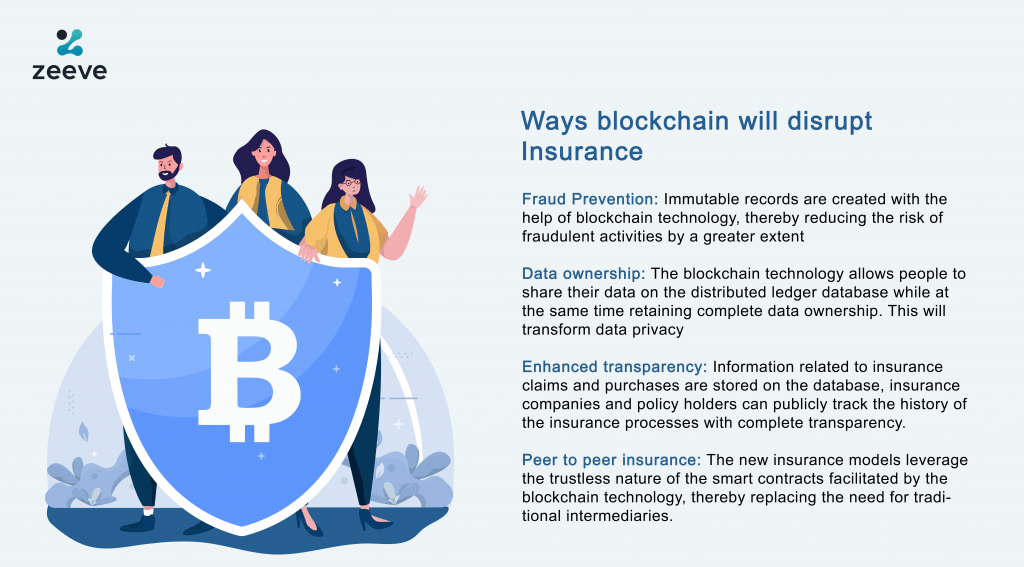

Let us review the various ways in which the blockchain can transform the insurance industry:

- Detecting and averting frauds through smart contracts: In India, roughly $45 billion in insurance fraud occurred in FY2019. Frauds such as identity thefts, claim frauds, and eligibility frauds that policyholders were carrying out at the moment are at a record high. Such swindling activities can be reduced by using software built using blockchain-based smart contracts. By doing this, two things will happen. Blockchain technology will provide visibility into data that can’t be modified, which will be available for everybody. Third, smart contracts include information regarding an insured’s health, including medical records, claim amounts, identity cards, and the like. Additionally, the data stored within the smart contracts cannot be modified. A smart contract will react once a model has been validated, which ensures risk-free data flow and swift processing. A security vulnerability plugged by blockchain technology will also help to prevent fraudulent threats and facilitate automated insurance claims.

- Cost-effectiveness: Insurance companies are significantly encouraging the decentralized tech that allows them to reduce expenditures and increase their margins. The distributed ledger technology can help reduce expenses by more than $100 million yearly. Blockchain will prevent the duplication of information, furthering authenticity and structure, and also reduce loss or incorrect claims. Blockchain technology will also reduce costs by eliminating intermediaries.

- Interoperability between insurers and reinsurers: Information about the blockchain will be viewable by everyone and will make it easier for service providers to interact with each other to minimize error and build trust among all parties. Currently, new insurance contracts are acquired by numerous parties, which may lead to confusion and inconsistency due to inadequacies in third party verification. Yet, information on an open, searchable digital network saves time and builds confidence among all parties. Anyone can access the real-time database, thereby benefiting both insurance companies and policyholders, and any ensuing changes can be seen and also verified by all. The insurer’s dependence on the consultants for information will diminish considerably, automatically streamlining the underwriting process.

- IoT and blockchain: All information gathered by IoT devices can be sent onto the blockchain. This ensures that all records stored on the blockchain are protected, encrypted, and centralized. Any changes made with the data will be immediately reflected on the blockchain, which can be found in the insurer’s view. This feature makes it simpler for insurance carriers to receive alerts if any malicious actions take place on the blockchain.

- Peer-to-peer insurance benefits: The P2P insurance model is a relatively new insurance model that is still in the development stage. It has been devised with an eye to increasing transparency, lowering risks, and reducing fraud. However, insurance companies continue to have problems with this model’s complex structure, issues of scalability, and claim management. Blockchain technology could be used to solve these issues, and many experts believe that it could soon boost P2P insurance by reducing fraud and improving scalability.

- Other benefits: An event on the blockchain can help insurance companies track real-time results and adjust pricing, reschedule, or terminate, if necessary. The verified and validated data on the blockchain can be used for introducing new insurance plans, amplifying their reach, and identifying target markets in developing countries and rural areas.

Use-cases of Blockchain in 5 leading Insurance verticals

Blockchain In Travel Insurance:

The market for insurance worldwide is estimated to be an astounding $35 billion by 2025 and to tap the immense potential of the insurance segment; it needs to be free of its inefficiencies.

Pros of blockchain in travel insurance:

- The implementation of blockchain technology can help the travel vertical of the insurance segment to streamline various aspects. It is often observed that the erratic flight schedules, medical curbs, and other travel-related disputes cause serious disruptions in the smooth processing and settlement of the insurance claim process.

- However, the blockchain brings more transparency to the travel insurance segment. Moreover, it intends to make travel more accessible and also add more efficiency to the system. The data on the blockchain will help travelers to get a better understanding of the coverage and can also swiftly and smoothly get their claims processed almost instantly. Blockchain implementation also stands to benefit the insurers since they can gather more exact data on the already made claims for their future use and also facilitate efficient customer service.

- With the deployment of the blockchain, the insurance companies can work without facing much hassle as they can get a protected, decentralized database with complete travelers’ personal information stored in it. Furthermore, travelers would also get easy access to their personal details at any given point in time without having to rely on intermediaries or third-party providers.

Blockchain In Motor Insurance:

The auto industry is looking forward to harnessing the power of revolutionary blockchain technology to counteract several grave problems.

Pros of blockchain in motor insurance

- The deployment of the blockchain technology in settling the motor insurance claims can bring down the cases of frauds and also lead to improved efficiency.

- The data from the blockchain can be easily accessed by the insurance companies, insurers, reinsurers, and brokers alike, thereby bringing down the inconsistencies and also eliminating the risks of frauds.

- It will also be advantageous for the insurance firms who are required to pay hefty claim settlement amounts that are difficult to be verified and also require too much documentation. Hence,

- With the decentralized ledger, the motor insurance companies can get an accurate view of all the customer details as stored in the database and also take a look at the KYC papers. As such, this would make it easy for them to gauge the authenticity of the claims and settle them accordingly. Besides, they could also extend their motor insurance policies depending upon the customers’ driving record and after reviewing relevant details.

- Motor insurance companies can also tap the potential benefit of blockchain in removing the fake auto spare part firms. An industry report suggests that billions of dollars are lost each year by the auto sector because of the counterfeit spare auto components. Blockchain technology implementation can resolve the issue of fake parts with end-to-end vehicle identification solutions and services pertaining from manufacturing to the customer ownership.

- The use of smart tags such as QR codes and RFID tags as encrypted in the vehicle could make it easy to track and identify the vehicle.

- Furthermore, costs can be optimized with the implementation of the blockchain technology and smoother payments, efficient processes and also enhanced customer services can be facilitated with the blockchain technology.

Blockchain In Healthcare Insurance:

Every year, a large number of fraudulent health insurance claims are filed that lead to massive losses for healthcare players and insurance companies. The recent industry reports show that the healthcare sector suffers losses worth billions every year for the swindling insurance claims.

Pros of blockchain in Health Insurance

- Executing the blockchain technology is a better approach to counter the risks of frauds for the insurance providers. The decentralized ledger will give insurance firms the access to exact patient data

- Blockchain in insurance can improve the chance of removing the fraudsters as well as processing the authenticated claims.

- A blockchain that could provide access to a more browsable and easy-to-understand set of medical records may instill comfort and peace for those going through an intrusive and repeatedly tested process.

- Blockchain systems can be used to store health data safely on a smart contract, creating a foundation for integrated health care behavior in the insurer client.

Blockchain In Agriculture Insurance:

In recent years, there have been many changes in climatic conditions which have led to lower agricultural yields. These developments can worsen as time progresses and may eventually affect all aspects of life including food production for humans and animal husbandry practices like dairy farming or horseback riding. However , one way that you could help protect yourself from these effects is by purchasing insurance through an agency specializing in agriculture-related risks such as those caused due to poor weather events . An example would include hurricane damage where normally healthy crops might get wiped out instantly without any warning whatsoever

Pros of blockchain in Agriculture Insurance

- The insurance industry is facing obstacles largely because of technicalities and lack of data. Small farmers are suffering from not getting enough money for their claim, but blockchain technology can help them.

- Blockchain in agriculture can make sure all aspects (smart contract) get processed through an automated system called “the ledger.” The recognition of this loophole by insurers has led them to switch from an indemnity-based insurance model, which is based solely on the history and severity levels associated with each individual claim made against it during its lifetime (ie: if you’ve had more claims than anyone else), towards weather-related Index Insurance.

- Blockchain technology can help immensely in making these payouts automatic through smart contracts.

- Additionally, data about agricultural produce will be stored on blockchains creating index assessments that are more cohesive than ever before!

Blockchain In Life insurance:

The possibilities of using blockchain in dispersing life insurance payouts are endless.

Pros of blockchain in Life Insurance

- The parties involved in life insurance policy create KYC details on the ledger that contains their complete information such as id proof and financial records, current policy info., previous coverage etc., which all get stored securely with an unchangeable date identifying when it was created or last updated through cryptography for security purposes making them tamperproof so no one but those who have access can change any data within its code.

- A blockchain that could provide access to a more browsable and easy-to-understand set of medical records may instill comfort and peace for those going through an intrusive and repeatedly tested process.

- If a fraudulent claim is submitted to a health or life insurance policy provider via false reports, applications, or other channels, smart contracts may be used to verify that the claim is legitimate.

Disadvantages of Blockchain in the Insurance Industry

Introducing blockchain technology to insurance also has its drawbacks. With the growth of decentralization, blockchains become safer by removing any single point of failure. When just one entity generates the blockchain for a particular purpose, the computers that serve the network (referred to as nodes) may end up being centralized, allowing for the formation of a single point of failure, thereby negating the prime advantages of blockchain.

There may also be a difficulty with trust. With the Bitcoin blockchain, users trust the transaction record because it helps create Bitcoins. The moment they mine the Bitcoins, everyone can see where the bitcoins go, exactly when they moved, and what crypto wallets they were in. All of that information is accurate if the information is recorded on a decentralized network with no centralized authority or database.

The most common application of blockchain technology is for assets that do not originate on-chain (like insurance claims), but were originally founded on another resource. Because of this, it’s possible that the data being put onto a blockchain could be erroneous. And if the blockchain is to be trusted, the error may never be adequately corrected

Final thoughts

Blockchain’s potential in the insurance industry is tremendous. Insurers are looking at how blockchain could be used to simplify and improve their operations. One area that specializes in the blockchain is the improvement of the recording of insurance claims. Blockchain can be used to design tamper-proof databases of consumers’ information. The list of ways blockchain can be incorporated into insurance is considerable, and it is likely that there will be more developments in this area in the coming years.

In conclusion, blockchain technology is revolutionizing the insurance sector by making it more efficient and transparent. This is good news for consumers, who will benefit from lower premiums and faster payouts. Insurance companies are also taking advantage of blockchain technology, which is helping them to reduce costs and fraud. So far, the results have been impressive, and there is no doubt that blockchain will play a major role in the future of the insurance industry.

About Zeeve

Zeeve is the primary Blockchain as a Service (BaaS) platform that supports businesses and blockchain start-ups to build, deploy and manage decentralized apps and blockchain networks. It serves as a low code automation platform that supports several blockchain protocols with cutting-edge analytics. It not only deploys and builds the networks but also monitors the nodes. Explore the dominant set of APIs to set up DApps for a series of use cases across insurance verticals. With an experienced and expert team of blockchain solutions providers, we support applications in all spaces. Get to know more in detail about the impact of blockchain in insurance in resolving the key industry challenges and the blockchain as service offerings – nodes and smart contracts by connecting with us!