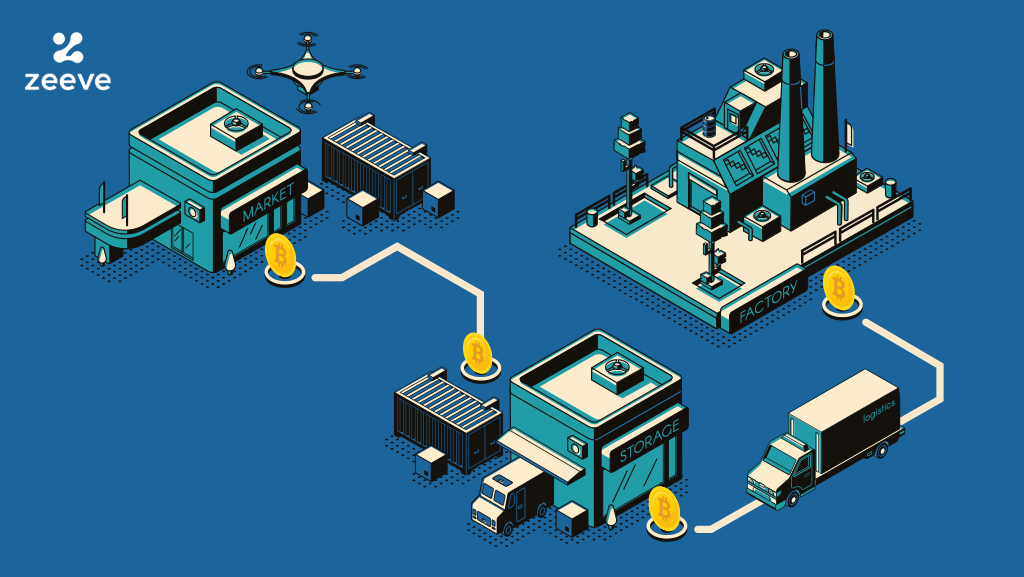

Supply Chain Finance (SCF) is an integral segment of the Supply Chain sector, which is a key driver of any economy. Supply chain finance is utilized by corporations to link buyers & sellers with financial institutions, helping to clear and unlock working capital that’s locked up in the supply chain. Supply chain finance (SCF) is a big and rapidly developing industry. SCF is recognized as a highly significant zone for development and strategic focus over the years. In simple terms, it is the financing of goods and services as they move through the supply chain.

Overview of Supply chain finance

Supply chain financing (SCF) refers to the methods and techniques employed by banks and other financial businesses to manage the capital invested into the supply chain and mitigate risk for the parties involved. Supply chain financing allows companies to improve their cash flow through various means, including factoring, invoice discounting, and supplier financing. Undoubtedly SCF is a relevant point of discussion for businesses involved in trade and trade finance to be acquainted with. Supply chain finance is an efficient strategy that is agreeable to buyers, suppliers and their clientele to help the financial and operational flow in the business. Supply chain financiers provide a wide variety of remedies for their clients, providing those solutions in an effort to buy their manufacturers enough time to receive and make due payments. Supply chain finance companies help suppliers get payments early from buyers and also extend their payment terms. In this way, suppliers can get enough cash and buyers can get help in optimizing their working capital.

Despite its advantages, supply chain finance doesn’t solve everything. For instance, it is usually restricted to the largest suppliers. Small businesses and start-ups suffer, which is unfair because they are able to take advantage of early payments. Some stakeholders are aware of the problems and have developed a number of supplementary solutions to improve supply chains. Numerous proposals have been put forth, but nothing looks ideal while some have opted to use blockchain to enhance supply chains. There are numerous use cases of blockchain and in this blog piece, we would attempt to explore how decentralized, distributed ledger technology can solve some of the key challenges impacting the world of supply chain finance.

Supply chain finance and blockchain technology are leading businesses to drastically change their commercial environment. As companies continue to expand, they make new domestic and global ties in order to enhance their procurement process and find ways to acquire less expensive alternatives. This has very positive effects on accounting books, but it can cause short-term working capital problems as well. Valuable financial resources may end up being locked into supply-chain requirements.

How can blockchain improve supply chain finance?

People initially think of digital coins when they hear about blockchain, but blockchain isn’t just digital money. It’s a sophisticated ledger system that’s valuable for many industries. Any transaction activity on the ledger is distributed across all decentralized systems that participate within it. The transparency of the blockchain ledger makes every transaction obvious to everyone in the network.

The blockchain can supply businesses a platform to streamline and automate supply chain finance processes. This can help other businesses save money on operations and enhance efficiency. The blockchain also facilitates trust and continuity between parties in transactions.

Supply chain finance, also referred to as reverse factoring, is a funding alternative used by companies that have made purchases (buyers) to send their suppliers an advance on their invoices. Unlike traditional factoring, in supply chain financing, funding comes from the buyer’s bank at a rate based on the buyer’s credit rating. As a result, suppliers tend to get funding at a cheaper cost than what they could have attracted by themselves.

As in supply chain finance, the advantages of blockchain may be more obscure than in trade finance, which has been historically associated with cumbersome paper-based processes. But there’s been a lot of talk on how the technology could play a role in supply chain financing solutions. The intersection of supply chain finance and blockchain technology has remarkable benefits for the relevant stakeholders. Some of these include:

It increases authenticity in the supply chain

Supply chain finance is a large network with many stakeholders. From buyers to suppliers, middlemen, and so on, there are thousands or millions of players in the game, and the exchange of information is not always transparent. Each interest group can choose their loyalty over others, which can result in protracted supply chain processes.

Blockchain may eliminate this issue. A copy of the same ledger that displays information shared in the district is distributed among the participants, who all have access through the network. The unalterability of blockchains prevents misinformation and guarantees truthfulness and credibility within the network. It can help streamline survival strategies and streamline the supply chain. Blockchain’s ability to make an immutable chain of transactions helps build trust and confidence between the parties. Blockchain may be used by companies to verify receipt of invoices and approve payments that are due.

Brings inclusivity to the ecosystem

The supply chain financier system today has numerous deficits, particularly when it comes to providing financial help to SMEs. Sometimes, the leading suppliers are often asked to fund the top 10 to 50 companies, whereas small and medium-sized businesses get left behind. This is unfair, because smaller businesses may gain by being offered early payments through supplier-led supply chain finance more than larger companies.

Financial institutions are generally the financers in buyer-led supply chain finance. They are the ones that make the invoice payments to the suppliers. Buyers pay them back through a repayment plan consisting of the borrowed sum along with a small fee and interest.

Blockchain technology can assist in this issue by leveling the playing field and encouraging access to banking funds of any type. The decentralized design of blockchain networks enables financing sources to finance any type of invoice, and records each transaction on every of the network’s ledgers. Each transaction and information exchange is recorded on the ledger, so finance providers do not have the option of denying access to financing to only the largest carriers.

Redefines financiers in the supply chain

Financial institutions are the suppliers in the financing market of buyer-supplier supply chain financing. They make payments to suppliers on their behalf and send them a repayment schedule that includes the amount borrowed along with an additional fee and interest.

While financial institutions will play an important role in buyer-led supply chain finance, blockchain could open the door to various stakeholders in the system. Corporate foundations and individual investors may also participate in supply chain finance and earn returns on their investment. Platforms such as CredSCF are already using blockchain to allow different financiers to loan money.

Enhances the functioning of the supply chain

It’s often difficult to make sense of economic data when there are multiple parties involved. Supply chain finance has suffered in a similar way to this one. Information inaccuracy is, in fact, one of the biggest contributing factors to why supply chain finance has struggled to solve long-standing supply chain issues.

In contrast, supply chain finance that incorporates blockchain technology may help make the supply chain more efficient. The immutable and transparent ledger can maintain information about moves and expenses in real time, streamline financial resources, and facilitate more effective and smooth business operations.

Smart contracts can be automated through smart contracts or blockchain can be leveraged to facilitate pre-shipment trade finance.

Blockchain and trade

The objectives of blockchain in the context of international exchange and trade financing have been examined quite widely. Blockchain enables exchange of data between participants in a transaction activity without the need for paper records. A key concept where blockchain is concerned is the use of self-executing contracts , in other words, algorithms based on computer code that is stored on a blockchain. Other benefits include privacy safeguards, an unparalleled level of security and transfer of funds, plus 24-hour accessibility.

Blockchain may have a useful role to play in reducing the trade finance gap between the demand for this technology and the proven capacity to supply it.

The Asian Development Bank evaluated in a 2019 news article how blockchain technology could be utilized to ease Asia’s trade finance gap, estimated to be $1.5 trillion although the board noted high prices and a lack of international standardization as obstacles where adoption is concerned.

We understand that hype is a common feature of talks with regard to blockchain, but there is also a great deal of experimentation happening in the domain of real world trade. Some of the most recent advancements concerning blockchain-based trade finance have been outlined in recent years, upwards of which consist of digitizing trade archives and simplifying paper-based finance tools for example letters of credit.

Limitations of blockchain in supply chain finance

Blockchain might become a useful tool in the world of commerce sometime in the future, but it is unlikely that we’ll see this kind of innovation happen in the field of financing until the technology develops further. Experts foresee blockchain playing a role in the global flow of finance in the immediate future. For now, however, this is unlikely to be accomplished due to difficulties relating to utilizing blockchain, as well as the technology’s maturity.

Blockchain technology in decentralized finance supply chain solutions would require intensive collaboration between participants, including an agreement to build and use the same protocol. The benefits of implementation would most effectively be realized with a critical mass of participants, meaning that a system of adoption must be established in which everyone has interest without the option for opting out.

Possible challenges to the distribution of the vendor-wide program will be the differing needs for improved transparency and protection, particularly in sharing information. And the arrangements would need to be put in place if a particular approach were to transform the industrial landscapes.

One of many

Keeping in mind blockchain (offshoot of potential energy technology) is not the sole technology that will shape the future of supply chains, it is also crucial to recognize breakthroughs in areas such as RPA, AI, and machine learning that have relevance to the distribution of capital in the future.

Artificial Intelligence (AI), for example, can develop knowledge concerning supplier plan habits, leading to more accurate forecasts about what suppliers will do in different situations. We’ll explore some of these topics in future articles.

In continuation of the thought, blockchain may not have much to do with supply chain finance for the time being. But it could be considered as one of many technologies that could help shape this area in the long term.

Closing thoughts

Blockchain, which is in its relative infancy, has already shown tremendous worth in diverse applications. Entertainment, banking, and payments have benefited from blockchain’s enormous potential, which will be further transformed in the coming years. Thus, it is only a matter of time before supply chain finance and blockchain technology combine and significantly improve supply chain finance.

Zeeve understands the importance of blockchain in supply chain finance. Our expert and experienced team works to identify the challenges facing the key economic driver and deliver best possible blockchain solutions and infrastructure management solutions in the supply chain financing domain. Get in touch with our team to know more about our services and learn how we can deploy, manage and share blockchain nodes for businesses in the supply chain financing sector.