Tokenization – a term once relegated to the tech-savvy and financial futurists, has swiftly moved from the peripheries to take center stage, reshaping traditional finance and the global economy with remarkable verve. Picture yourself on a speeding bullet train, rapidly hurtling towards the future. Now imagine that train is tokenization, and its terminal station? A radically transformed financial ecosystem.

A recent Deloitte study revealed that by 2025, worldwide investment in tokenization and the foundational technology behind it, blockchain, is projected to skyrocket to a staggering $1.4 trillion. These numbers have all the hallmarks of a revolution, but what’s stoking this blazing fire?

The answer is as simple as it is profound. Tokenization democratizes access to assets, untethered liquidity from traditionally illiquid sectors, ramps up security, and brings transaction efficiency into the space-age. Whether it’s real estate, invoice discounting, or bonds and debt – tokenization has slipped into every nook and cranny of traditional finance and the global economy, promising to re-engineer them from the ground up.

But before we venture further into this brave new world, let’s pause and answer two fundamental questions: What exactly is tokenization? And how is it driving a paradigm shift in the global economy and traditional finance?

The answer to the first question is beyond the scope of this article.

Read here: What exactly is tokenization? How Blockchain rewrites asset management?

Now, let’s dive into the 2nd question:

Different aspects of traditional finance and the global economy that tokenization is revolutionizing

Tokenization is revolutionizing different aspects of traditional finance and the global economy by offering innovative solutions and transforming established practices. From real estate and loans to equity trading, fund raising, KYC, invoice discounting, and more, tokenization is reshaping these sectors, unlocking new opportunities, enhancing efficiency, and promoting inclusivity in the financial landscape.

Let’s explore how tokenization is making a significant impact in each category.

- Tokenized Stocks:

Tokenized stocks offer numerous advantages that stem from the benefits of blockchain and tokenization. While traditional equity processes are considered efficient, tokenization can still enhance the way stocks are issued, traded, and managed.

One significant benefit lies in the automation of dividend repayment, allowing for faster and cost-efficient distribution to shareholders. Additionally, tokenized stocks are not bound by traditional trading hours, enabling 24/7 trading and potentially leading to smoother price movements and reduced volatility. The geographical limitations of traditional stock trading are eliminated, promoting a higher level of democratization and global access to assets.

Tokenization also facilitates the representation of different classes of equity and allows for the customization of governance rules, such as transferability restrictions and vesting periods, which can be coded into the equity tokens.

The streamlined processes and reduced reliance on intermediaries result in lower fees for both companies raising funds and token buyers. Moreover, tokenization improves liquidity by tapping into larger secondary markets, providing unrestricted time and geographic access, and enhancing overall market efficiency.

Custody and security will be crucial when dealing with tokenized stocks, as they are currently limited to trading on exchanges and may be vulnerable to security risks. Additionally, compliance with KYC procedures is still necessary for trading tokenized stocks, ensuring regulatory compliance and investor protection in line with traditional markets.

- Benefits on Equity Trading:

Equity post-trade value chain is one of the sectors that will immensely benefit from tokenization. Here’s why:

First: Currently, post-trading settlement is a complex and inefficient process. It involves a number of intermediaries, such as brokers, exchanges, and clearinghouses. This adds to the cost of trading and can make it difficult for small investors to participate.

Tokenization could help to reduce the cost of post-trading by eliminating the need for intermediaries. Tokens can be traded directly between investors, which would significantly reduce the fees associated with trading. This would make it easier for small investors to participate in the stock market and could lead to increased liquidity and price discovery.

Second: tokenization could make post-trading more transparent. Currently, post-trading is not very transparent. It is difficult for investors to track the ownership of shares and the price of stocks. This can make it difficult for investors to make informed investment decisions.

Third: Tokenization could make post-trading more transparent by recording all transactions on a public blockchain. This would make it easy for investors to track the ownership of shares and the price of stocks. This would help to reduce fraud and make the stock market more accessible to a wider range of investors.

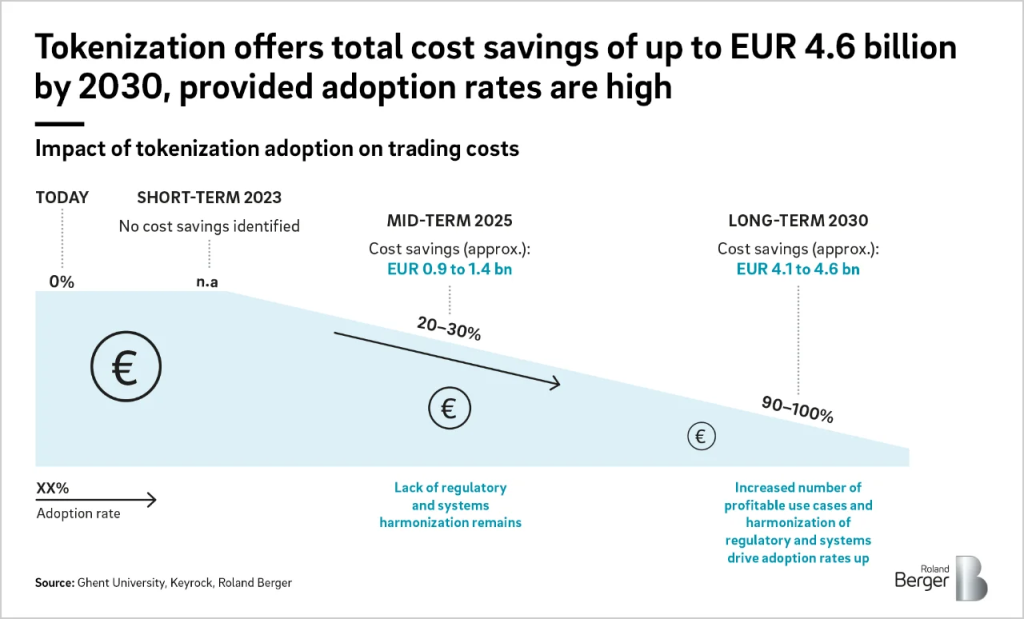

As per the reports published by Roland Berger, these benefits could lead to gains of EUR 4.6 billion by 2030.

- Fundraising Becomes Easy with Tokenization:

Fundraising becomes easy with tokenization as it revolutionizes traditional methods, creating new opportunities for both issuers and investors. Tokenization brings increased transparency and efficiency to fundraising processes while reducing entry barriers.

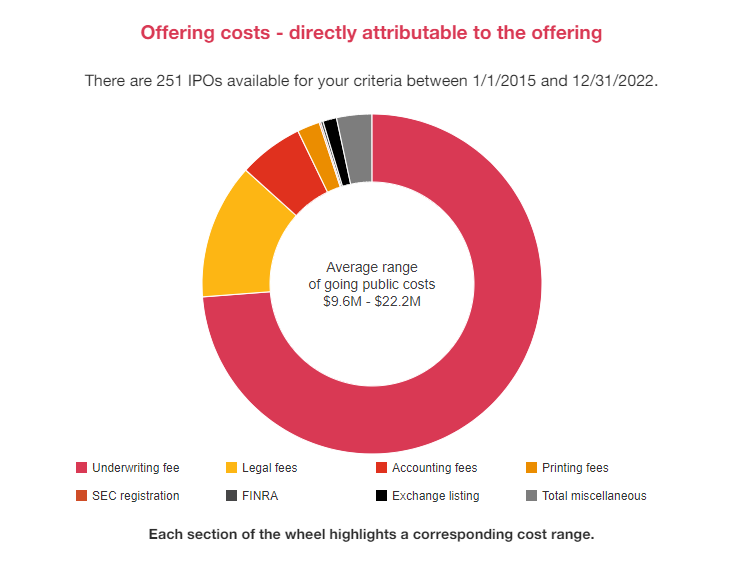

In the traditional market (For example in IPO), fundraising involves complex procedures, extensive paperwork, and legal actions, resulting in higher costs and longer fundraising timelines.

However, tokenization digitizes the fundraising process through token issuance (STO), enabling automated fundraising for underlying assets. This streamlined approach allows token issuers to raise funds efficiently from investors. Security token offerings (STOs) require limited disclosures compared to initial public offerings (IPOs), reducing costs for token issuing companies, particularly for tech startups.

According to PwC, the average cost of an IPO for which the last 12 months revenue is less than $100m, and want to raise around $100m – $249m in the US is $9.6 M. In contrast, STOs can be considerably more cost-effective, ranging from ten to a hundred times cheaper, depending on various factors.

Tokenization also presents a notable difference from institutional private placements, which typically involve large institutional investors. Institutional capital often comes with high bargaining power, demanding favorable terms such as a higher equity stake and board representation. Tokenization offers flexibility in choosing investors and setting terms, granting issuers higher bargaining power.

Additionally, tokenization enables trading and provides investors with greater flexibility for cashing out, eliminating the need for companies to meet unrealistic growth targets for founders to benefit from an exit.

However, it is important to note that while STOs offer cost advantages, traditional stock exchanges generally provide better access to investors and easier trading. STOs may require additional efforts to find investors, and although trading options may be more limited compared to stock exchanges.

- Getting Loans:

Tokenization offers significant advantages over traditional loans when it comes to accessing capital. One crucial advantage is its increased accessibility. In cases where projects lack tangible assets for collateral or when seeking capital for new projects or special purpose vehicles, traditional loans may not be available at all. Even if eligible, the interest rates associated with loans can be prohibitively high, making the overall cost of capital unattractive for businesses.

Tokenization also provides a superior “loan-to-value” (LTV) ratio compared to traditional loans. By offering tokenized debt securities, businesses have the potential to attract investors who find such offerings compelling. This flexibility allows for a broader range of LTV ratios, enabling businesses to secure the necessary capital based on investor interest.

Also, by demonstrating a transparent track record of transactions and timely repayments through tokenization, businesses can potentially improve their creditworthiness and enhance their credit ratings. This, in turn, can positively influence lenders when considering loan applications, as the transparent nature of tokenization can provide a more accurate and reliable assessment of a business’s creditworthiness.

- Credit Card: Tokenized Loyalty point

Lack of liquidity, complexity, and interoperability are stumbling blocks of loyalty programs – affecting customers and brands. A survey by eMarketer revealed that 79% of consumers are more likely to choose a retailer that offers a loyalty program over one that does not. Secondly, most loyalty points do not have a cash value.

This is where tokenization plays a role – making customers happy. For example, Singapore Airlines launched a digital miles wallet that allows users to exercise points with other merchants.

Additionally, tokenization increases business efficiency by reducing the manual processes of the loyalty point system. Smart contracts also automate loyalty systems, minimizing the potential for errors or disputes. Lastly, tokenized loyalty programs create a secondary market for trading these points.

- Tokenized KYC

KYC is crucial in the financial services industry as banks and institutions verify customers’ identities before offering financial services, including loans and payments. KYC processes include ID cards, face, documents, and biometric verifications. However, access to people’s data poses a risk of fraud when a system is compromised. Tokenization is set to revolutionize this for faceless and trustless identity verification.

Financial institutions can perform KYC by substituting unique ID numbers with a token that contains no user data. These tokens authenticate transactions without revealing the owners by matching the unique numbers of tokens with the owners. Therefore, access to people’s data, such as credit card details drastically reduced. Tokenization also reduces the risk of fraud when a system is compromised.

For instance, an onchainID can be created and it will enable market participants to verify their identity on the blockchain. It will help reduce the cost of KYC and also help prevent AML activities.

- Invoice discounting

Invoice discounting is crucial to keep brands in operation through third-party funds. A brand can sell its invoice to a third party at a discounted price. The benefits include immediate access to funds by the invoice-selling brands, reasonable profits by the third party buying the invoice, and time for the customer to process and make payment.

But the current process of invoice financing faces challenges such as the lack of a standard invoice format, difficulty in invoice verification, and the risk of double spending. However, tokenization provides solutions to these issues.

By tokenizing invoices and representing them on a blockchain-based platform, several advantages arise. Firstly, invoices become an accessible asset class for general investors, as standardization and quality checks increase transparency and reduce risk. Tokenization enables a more transparent ownership structure for invoices, as they are tracked on the blockchain, minimizing the risk of double spending and enhancing payment accuracy.

Moreover, tokenization leads to increased efficiency and automation, streamlining the entire invoice financing process. With standardized invoices, an invoice market, and automated payout mechanisms, the cumbersome manual processes are replaced with a streamlined and efficient system.

Invoice financiers benefit from an expanded market and simplified investor payouts, while investors gain easier access to a broad range of invoices. Overall, tokenization transforms invoice financing by overcoming its challenges, improving transparency, and optimizing efficiency for all parties involved.

- Tokenization of Debt Securities: Bonds, notes & commercial paper

The tokenization of debt securities, including bonds, notes, and commercial paper, offers significant advantages for both issuers and investors. One key benefit is increased accessibility, as tokenization allows investors to participate in these debt instruments with smaller transaction sizes compared to traditional bond issuance.

This broader market accessibility opens up investment opportunities to a wider range of investors, promoting inclusivity and democratizing access to corporate debt investments. Notably, prominent banks like DBS and EIB are actively involved in leveraging tokenization to issue debt securities.

By embracing tokenization, these banks and others are enhancing the efficiency, liquidity, and transparency of debt markets, ultimately transforming the way debt securities are issued, traded, and accessed by investors.

- Real Estate Asset Tokenization

One of the key benefits of real estate tokenization is the increased accessibility and liquidity it provides. By breaking down expensive properties into smaller, more affordable units, tokenization opens up real estate investment to a wider range of potential buyers. Small investors can become fractional owners of expensive properties.

It brings transparency and efficiency to transactions by eliminating intermediaries and utilizing smart contracts. Decentralization reduces counterparty risks and enhances the investment environment.

Learn more on: Tokenized Real world Assets

Conclusion

In conclusion, tokenization is revolutionizing traditional finance and the global economy across multiple sectors. From real estate to loans, equity trading, fundraising, KYC, invoice discounting, and more, tokenization offers innovative solutions and transformative benefits.

It enhances accessibility, liquidity, transparency, and efficiency, unlocking new opportunities and promoting inclusivity. However, challenges such as regulatory frameworks, security concerns, and the need for centralized reporting must be addressed. As tokenization continues to evolve and mature, its full potential will be realized, reshaping the future of the industry.

For organizations seeking to harness the power of tokenization, build with Zeeve and get access to over 40 top public and permissioned blockchain protocols.

Build your tokenization solutions with Zeeve and be part of shaping the future of finance