The decentralized nature of cryptocurrencies and open, trustless distributed ledger technology has brought upon a paradigm shift in the fintech world. The inclusion of smart contracts on cryptos like Bitcoin and Ethereum has expanded the horizon, providing limitless possibilities for the development of new applications. Blockchain technology provides for censorship-resistant, open, borderless, and trustless financial transactions between users. An important use case of the financial instrument being deployed on the blockchain using smart contracts is decentralized finance. DeFi Ecosystem is a hot concept that is accepted by enterprises.

This innovative technology promises to revolutionize financial systems and services. The immense potential of the DeFi Ecosystem is well known to the world but in this blog, we would go beyond that and talk about the hurdles and risks inherent in the DeFi ecosystem and also how these key problems can be resolved. We would give you a deeper insight into the economics behind the DeFi Ecosystem applications, and also carefully examine the existing roadblocks. Find a unique perspective on how the DeFi space might progress in the near future.

Overview of the DeFi ecosystem

Decentralized finance or DeFi Ecosystem is hailed as the technology of the future with the potential to reinvent the traditional financial systems and also accelerate the various services such as trading, lending, borrowing, exchanging funds, and also others. The blanket term of DeFi Ecosystem covers a wide range of new financial systems and products that are unique ways to help people manage their finances in a highly secure, reliable, transparent and also autonomous manner – without facing the authority or control of central banks or institutions.

The decentralized applications (dApps) are designed on top of the existing blockchain networks and also use smart contracts, allowing users to have complete authority over their own finances. The concept encapsulates a wide-ranging financial application without the need for intermediaries, brokerages, exchanges, and also banks. Almost anything related to the financial system offerings such as savings, payments, trading, lending insurance, and also extending to investments, prediction markets, the DeFi concept plans to transform all of the processes.

Users on the DeFi ecosystem need not have to be involved with any centralized authority. The decentralized, open and distributed ledger technology makes financial activities efficient, time-saving, transparent, and also cost-saving – some fundamental features that the traditional financial systems and processes still continue to struggle with immensely. However, DeFi is not completely flawless and there are certain hurdles that need to be tackled to realize the vision of making DeFi the greatest of all financial innovations to date.

There is no denying the fact that there is enormous potential in the DeFi ecosystem given the varied range of advantages it offers in contrast to the ones facilitated by traditional finances. The ingenious DeFi products and the wide range of promising services are benefiting financial key players. However, the DeFi space is still at the nascent stage of development and there are innumerable difficulties with mass adoption. We attempt to look at the key challenges and also analyze some potential solutions for those problems.

Who makes up the DeFi ecosystem?

In contrast to the traditional finance systems, a number of participants are involved in the DeFi Ecosystem market. Most of the players involved in the DeFi market are the lenders with fund availability to loan out their assets. Borrowers often look for easy and speedier access to those financial assets. It is for providing quick access to loans that exchanges act as mediators between the lenders and borrowers. A number of facets are also involved and solutions are given to meet the needs of borrowers and lenders in the decentralized financing world. There are endless possible configurations of the DeFi services and certain core categories include the introduction of peer-to-peer marketplaces for facilitating lending and borrowing, trading, exchange, the tokenization of real-world assets such as art and real estate, insurance, healthcare, staking, and also alternative savings with interest-earning mechanisms.

Popular use cases of DeFi

A popular use case of DeFi in today’s market is the DeFi lending and borrowing platforms. Lenders have a significant amount to loan out assets and are always in the search for ways to earn more interest on their asset holdings. Their asset holdings also play an important role in surpassing the normal market appreciation. The lenders providing funds on a long-term basis are also given out rewards for facilitating liquidity for an asset and using a particular lending platform to do the same. It is a win-win situation for those adding the liquidity to the asset’s market while also opening up an avenue for earning passive income for the lenders adding the liquidity.

Even borrowers on the Defi lending platforms stand to benefit immensely. They can hold control of the resources lent out by lenders even though it comes at a price. Borrowing an asset offers users the chance to trade that asset for profit on exchanges that render no support to margin trading. Furthermore, lending and borrowing platforms can also provide easy and quick access to utility tokens which the borrower may use for some other task such as for participating in a voting process on a network. Flash loans are also provided as a financial instrument to facilitate users with adequate loans and let them use the borrowed money in a judicious way while they are also required to repay the loan in a single transaction.

Built on the foundation of distributed ledger technology and smart contracts, the role of intermediaries in exchanges is done away with and hence there is no significant amount that goes as a commission towards these middlemen. Users have full custody over their funds and it also minimizes the security threats that often lead the centralized exchanges to lose millions of dollars worth of cryptocurrencies owing to the cyber-attacks and threats and mismanagement.

Another space to watch out for in the Defi sector is the DEX platforms. Liquidity pools are the emerging sectors and platforms like the Bancor Network and Uniswap prompt users required to facilitate diverse exchange pairs. A few DEX platforms like to create and also fund liquidity pools. A token user willing to exchange it with another token can add to the liquidity pool for that token so that others can exchange and also trade for it. The open process underplays the idea and also the process of getting listed on decentralized exchange platforms.

Inherent risks, challenges in DeFi, and their potential solutions

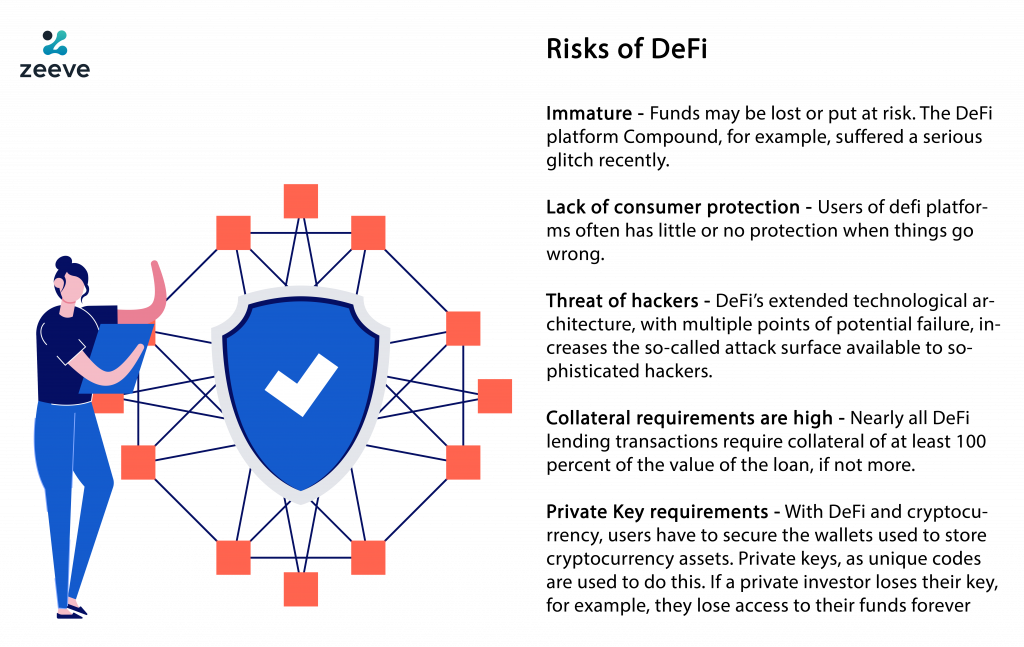

DeFi, although hailed as the tool for reinventing the entire financial industry on the foundations of digital assets, distributed ledger, and smart contracts, is still at a nascent stage. Even though Defi has great advantages of providing an open, transparent, reliable, efficient, and low-cost platform, there are some downsides too to using these platforms.

Here are some major risks associated with the DeFi and also the possible solutions for resolving these key challenges:

- Smart contract vulnerabilities:

Smart contracts powering the DeFi services were brought in to cut down the role of intermediaries. A major disadvantage of the smart contract-powered Defi markets and services are the vulnerabilities that come with the smart contracts. The programmability and compostability of DeFi make it an innovative financial instrument but if a contract is released with its flaws and loopholes of the code then the entire ecosystem stands exposed, leading to a significant loss of funds. Any sort of smart contract malfunctioning will inevitably impact the specific DeFi solution’s entire ecosystem.

There have been instances in the past when the smart contract code flaws have affected Ethereum. Although these notable episodes have given rise to the occurrence of regular audits and peer reviews, there is still no guarantee that there will be no issues with the smart contract codes in the future again.

The latest cyber-attack against the bZx protocol serves as a current instance where the smart contract vulnerabilities were exposed as a major downside of the Defi. In this attack, the hacker stole thousands of dollars worth of Ether by taking advantage of the smart contract vulnerabilities and of the loopholes in the intricate mechanism of how the flash loans operate. Although events such as these do prompt the blockchain expert DevOps to provide updated solutions for the underlying challenges, there are likely to be more errors waiting to be exploited and misused by cybercriminals and hackers.

Solving smart contract limitations

Adhere to the best development practices so as to improve the smart contracts. Different projects have varying smart contract architectures and depending on the specifics there are certain best practices that can help you build a strong smart contract. It is important to follow the best development standards for the blockchain networks you use. Non-alignment with best practices can land you up in trouble with the complex multifunctional smart contracts with severe security vulnerabilities. Also, make sure that you perform the smart contract auditing and testing thoroughly. There is no way to rectify the errors and fix the bugs identified at the last minute after the contracts have been deployed. Use testing coverage analysis, static code analysis, and tools for testing as well as symbolic execution.

- User Errors

Another major issue associated with the previous problem of smart contract vulnerabilities is user errors. Despite designing flawless codes on which the DApps operate in a seamless manner, it is difficult for developers to anticipate all potential problems in which the users will engage and interact with their applications. There have been several instances in the past where a significant amount of funds have been lost because of the users mistakenly sending their funds to the incorrect addresses.

Solving the problem of user errors

This challenge of using DeFi can be resolved with the introduction of new token standards such as ERC-777 that can identify and also block these mistakenly carried out transactions, although this would translate into higher transaction costs.

- Internal Governance of the assets

Often a disadvantage of Defi that is largely overlooked by users is the internal governance issues related to an asset. The risks of any sudden change with the external regulations are potentially very high with DeFi projects. There are always possibilities with how a project can alter the way that operates the platform and the manner in which it is being run. Sometimes, there is no warning and often no intimations about the project or no warning. Moreover, there can be new regulations from the local governments– they can call out for augmentation of a particular currency to be used or also declare a specific currency to be completely illegal.

- Control to developers

A pertinent problem with the DeFi is that despite being non-custodial in nature and with a decentralized framework, it doesn’t remain decentralized in the same way it should be. In often a number of projects the control is being given to the hands of developers and they are entrusted with such high controls that the network is also built and the issues are responded to in a manner where they can have an upper hand. Although these are not totally harmful as issues can be fixed in a timely manner but often it leads to a scenario where the DApps that are meant to be open, transparent, reliable, and also distributed technology still remain a centralized force in some way. It can be quite hazardous even if the team working on the products is reliable since it can lead to the misuse of user funds.

The solution to centralization issues:

The developers also recognize that centralized control in the hands of developers of a particular blockchain network can spell huge problems and hence they often choose a “progressive decentralization” approach so as to redress the key problem of centralization. The approach ensures that even though the developer team originally controls the product but eventually the governance of the project designed to be released is soon passed on to the community over a span of time, thereby gradually turning into a self-regulated, decentralized network after the development team is done with fixing the issues.

- Non-clarity with the legal framework

A key risk area with the Defi projects, in particular, is the absence of clarity with regard to the legal framework. Despite having the best security features in a Defi project and implementing fair processes, there is absolutely no guarantee that the government would not interfere with the legislation and introduce new rules. The government regulations may enforce the developers of the DeFi projects to bring about specific changes in the architecture of their designed solutions and business model where they retain the central control.

Solution for the lack of clear legislation

Even though there is a complete absence of comprehensive regulatory norms for DeFi yet, the process of defining such a legal framework has already begun. The discussion of the legal issues in the World Economic Forum In June 2021 led to the introduction of the Decentralized Finance (DeFi) Policy-Maker Toolkit whitepaper that charts the possible legal and regulatory responses required to resolve the legal issues in the space. Keep a close tab on the news and events in the Fintech regulatory space and also look for any information provided by the Strategic Hub For Innovation and Financial Technology (FinHub). Those Defi project developers with a plan to develop functionalities not covered by the existing legislation can factor in the potential risks that this functionality can run your project into given that those functionalities are forbidden.

- Low liquidity

Liquidity refers to the pool of funds available for performing different tasks within the same platform. It is the extent to which an asset can be quickly purchased or sold at its inherent price. The fund pool made available for the purpose of exchange or loaning is also referred to as liquidity in the blockchain. The problem of low liquidity also translates to higher volatility in the markets thereby pushing up the prices of cryptocurrencies and also causing a lack of assets. This scenario occurs when several types of assets are present in the market.

Solving the issue of low liquidity

One of the most effective ways to resolve the problem of low liquidity of a certain cryptocurrency is to attract more users to adopt it, maybe by engaging more users with enticing incentive programs and financial benefits. The use of automatic swaps and also exchange contracts lets parties trade tokens from different blockchains. It is a practically affordable approach but however doesn’t address the problems of the market getting flooded with a range of highly dedicated tokens.

Using the decentralized liquidity pools could also be an effective way of handling the low liquidity issue. With liquidity pools having the tokens locked into a smart contract, efficient asset trading can be carried on and investors can also receive a good return on their asset holdings. The DEX platforms function as an attractive marketplace for buyers and sellers to settle on their asset prices based on the comparative supply and demand. The disadvantage of this model shows that the efficiency of the liquidity pools rely on having adequate buyers and sellers to create the required liquidity.

- High transaction fees

Another major problem tied up with the problem of low liquidity is the higher transaction fees. In some cases, users have to pay exorbitant fees for buying and selling off their assets, especially in cases where there is a lack of certain cryptocurrencies. In these cases, users are restricted to indulge in free exchange of their assets thereby rendering the financial system quite ineffective.

Solving the problem of high fees

Users can choose the feeless transactions as a way to override the problem of exorbitant fees. It can be achieved in several effective ways – one being subsidizing the platform to cut down the cost of transactions and another way is using multiple tokens.

- Performance issues

Although the DeFi projects ensure transparency, openness, and reliability they also came with some major disadvantages such as a slower transaction speed and scalability challenges that made the performance of the overall system go down drastically. The blockchain nodes record every transaction and anyone can see them, thus ensuring complete transparency and security. But it also restricts the number of transactions that can be processed concurrently.

Solving performance issues

Defi projects have to bring up some highly revolutionary ideas for increasing their speed if they really want to outpace and beat traditional finance. Those working only on Bitcoin-powered applications can resolve the problem of scalability and speed with the use of the Lightning Network. This protocol operates with the concept that the final transaction for any activity needs to be recorded on the blockchain. A peer-to-peer payment channel can be established between two parties with this protocol. It requires the payer to lock a certain amount of BTC into the network for the recipient to raise the invoice amounts. Ethereum powered applications can use state channels as possible solutions for enhancing the speed and scalability of blockchain projects. Users in the state channels can engage in transactions with one another directly outside of the blockchain and also reduce the strain on it by simply grouping similar transactions. It helps in enhancing speed and scalability.

- Hacking and attacks

A common danger with the DeFi projects is the entry of cyber hackers with malicious intentions to hamper the financial sector. Malicious hackers always find new methods to steal funds and launch flash loan attacks. They often illegally make their way into the smart contract’s function and gain control over the unreliable contracts, thus jeopardizing the whole ecosystem.

There have been several incidences of re-entrancy vulnerabilities in the DeFi lending market. One instance is where hackers maliciously made their way to borrow assets worth around $24.75 million in total in the DForce lending market and also stole all of the assets stored in the lending application.

Attackers in the flash loan borrow a good amount of money to exploit the market and manipulate it to vulnerable DeFi protocols for their own benefit.

Solving issues with hacking and attacks

Addressing the problem of hacking and tackling cyber-criminal activities is essential for all DeFi projects. Developers need to tighten their controls over the codes and thoroughly check for all weak spots which give hackers a chance to exploit the vulnerabilities. Performing a security audit of smart contracts is necessary to prevent hacking of Defi applications. Make efforts to write flawless code and maintain security audits to identify vulnerabilities and also check for security vulnerabilities that could be exploited by hackers.

- Lack of talent

Defi projects often suffer because of the lack of competent developers and professionals in the domain. Also, Defi projects face stiff competition from blockchain and non-blockchain organizations, including financial institutions and banks when it comes to hiring the right talent with a strong understanding of financial technologies. The talent shortage is crippling the growth of the blockchain industry. Blockchain technology requires people to explore them, review the nuances involved with DeFi projects and also build up relevant expertise. The increasing interest in blockchain projects and Defi, in particular, is likely to push more people to go for certified blockchain courses and generate the right talent required for these projects.

Solving the issue of the right talent

The key to hiring blockchain experts is creating a robust developer team that has good knowledge of the Defi applications. It is also important to recruit a skillful project manager for your Defi project that can efficiently manage all the processes and provide top-quality products and solutions. Hiring an expert business analyst and building a testing team with good experience in crypto and finance projects can help in identifying the opportunities and problems with the projects before starting off the Defi solutions development.

Other problems holding back mass DeFi adoption

Besides the above problem obstructing the adoption of Defi, some other issues such as over-collateralization and very little interoperability between blockchains are some of the key challenges with the Defi projects. With the Defi lending and borrowing platforms, there is a little guarantee provided with such volatile markets, and the biggest problem of over-collateralization remains. A situation arises where several lenders stop working with a borrower unless they can provide a significant amount of assets as collateral.

This leads to a scenario where the whole objective of DeFi Ecosystem to make financial services available to the unbanked is being defeated. It also leads to significant cuts in the profit margin on leverage trading, often off-putting users on those platforms as well. Other problems pertaining to the unpredictability of the market combined with the lack of insurance pose some real threats to investors for losing significant money when using the decentralized services.

Final thoughts

Even though the Defi ecosystem is still in its infancy, it has to find an effective way to surpass these issues and tackle the key challenges obstructing the growth of the young and ambitious industry. If it hopes to achieve stupendous growth levels and supplant the existing legacy systems then it has to address the current hurdles and also achieve a seamless user experience with the right Defi solutions and products developed with secure industry standards. Designing a reliable, open, efficient, transparent Defi project is a true challenge but unclear requirements and complicated technologies only make the task more difficult to achieve. However, a robust developer team and a strong grasp of the fundamental features and knowledge of possible pitfalls and solutions to them can help in building a successful Defi product.

Zeeve as a Blockchain management platform

Zeeve is the primary blockchain infrastructure services provider empowering start-ups and enterprises to build, deploy and manage reliable decentralized apps and Blockchain networks. It is a no-code automation platform providing support for various blockchain protocols. It features a powerful set of APIs and has experience in designing various enterprise solutions in the blockchain space. Zeeve supports Decentralized Finance (DeFi) space with decentralized storage, trusted nodes, and smart contracts.

For more details about deploying and managing blockchain nodes and networks for your DeFi projects, contact us today!