By Ravi Chamria

NFTs, tokenized assets, and digital ownership are about to shake up the world in a big way. While Web 2.0 brought digital ownership into our lives, a fresh concept for a world familiar only with physical assets, Web 3.0 is poised to take this further. It is transitioning conventional assets into on-chain equivalents, creating digital twins for physical items, and simultaneously introducing new purely on-chain assets. Plus, improves the provenance and ownership attached to existing assets, making our virtual and digital ownership as valuable and real as physical ownership.

NFTs leap towards a future where digital assets hold real value and ownership is clear and transferable

In a world increasingly dominated by digital interactions, the concept of ownership is seeing a Web3 makeover with Non-Fungible Tokens (NFTs). Unlike traditional ownership models that are often restricted and easily replicated, NFTs bring a new layer of verified authenticity and tangible ownership.

Consider the limitations of non-tokenized digital assets: you might not truly ‘own’ the music you stream on platforms like Apple Music or Spotify, nor can you legally sell in-game items for real money due to the risk of fraud and platform restrictions. This changes with NFTs, engineered to be freely transferable, whether they are digital versions of physical assets or inherently digital creations.

This shift has profound implications. For creators, NFTs unlock new avenues for monetizing digital art and collectibles. Through disintermediation and tracking of secondary transactions, creators can maintain control and earn from their work without undue interference. Collectors and investors benefit from efficient ownership transfers, reduced intermediary roles, and the opportunity to diversify portfolios with alternative asset classes.

Each NFT is unique, embedded with specific metadata that ensures its one-of-a-kind status, making it a coveted item for collectors and a valuable tool for creators asserting digital ownership. Beyond mere ownership, NFTs extend to represent other rights, such as exclusive access to digital content or membership in elite clubs. Imagine owning an NFT that grants you entry to a members-only concert or a prestigious conference.

In gaming, they’re turning in-game assets and rewards into securely owned, tradeable items. In the music industry, they’re rewriting rules around copyrights, publishing rights, and performance royalties, making them more accessible and fluid.

Even beyond entertainment, businesses are leveraging NFTs for innovative branding and customer engagement. From loyalty programs to exclusive event access, NFTs create innovative touchpoints with users.

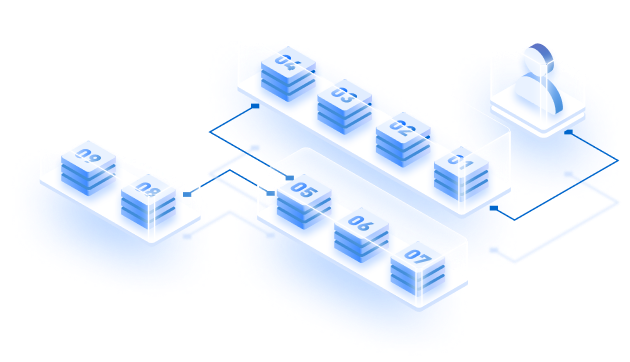

With NFTs redefining ownership, their potential in broader asset tokenization is equally transformative

Stepping into tangible assets, NFTs are now unlocking new dimensions in finance, supply chains, and real estate sectors.

In finance, they bring a secure, transparent structure to asset management and investment. Although fungible tokens currently dominate financial applications, NFTs present untapped potential for certain use cases. Tokenizing trade documents with NFTs, for instance, tackles fraud and money laundering challenges in trade finance by ensuring the authenticity of product origins. Tokenizing trade documents such as bills of lading and letters of credit secures transactions and simplifies complex international trade processes. Bonds can also be tokenized as NFTs to represent the entire bond issuance on-chain, with individual shares of the bond then distributed among investors as fungible tokens.

Banking is undergoing a radical shift, with NFTs enhancing digital identity verification, particularly in KYC processes. This application not only bolsters security but also streamlines operations, reducing the time and effort involved in client verification.

In Regenerative Finance markets, carbon credits as NFTs enhance ESG initiatives by offering a clear, traceable mechanism to verify and trade environmental impact credits tied to distinct sustainability projects.

In supply chains also, NFTs promise a leap in efficiency. By serving as digital receipts and records, they reduce oversight needs and centralize information access. From raw materials to retail shelves, these non-fungible blockchain receipts can track every transaction, enhancing transparency and minimizing waste.

The real estate sector is also witnessing a shift with NFTs enabling new forms of property investment. While tokenizing entire assets remains a challenge due to regulatory constraints, fractional ownership is gaining ground. This approach allows investors to purchase shares in property assets, secured and transparently managed through NFTs. It’s a development that’s simplifying investment processes and democratizing access to real estate markets. While we’re yet to see NFTs transfer whole properties, their role in virtual real estate is burgeoning, offering new socializing, working, and gaming spaces within the metaverse.