Blockchain has the potential to disrupt every industry, and the Banking and Financial industry are arguably the most prominent among all. Blockchain technology’s features, such as distributed ledger, immutable records, real-time payments, transparency, and security, can potentially solve various existing inefficiencies of the financial system.

Traditionally, the financial services industry is known for its legacy systems, and some banks have loads of legacy systems, some of which are 20+ years old. Therefore, It becomes necessary for the financial services industry to embrace Blockchain and improve on many of its outdated systems.

Banking giants such as Credit Suisse, JP Morgan Chase, Goldman Sachs, Citigroup, etc have caught on to this trend & have started experimenting and partnering with Blockchain tech companies to automate their banking functions. In fact, R3 was the first Blockchain consortium with more than 100 banks and financial institutions as its members.

According to a MarketWatch report, total investment in blockchain in the banking and financial services sector amounted to $2.3 billion in 2018. The report also forecasts that the expenditures will reach $17.47 billion by 2025, with a CAGR of 33.6% for 2019-2025.

Post – Covid: Adoption of Blockchain in FInance & Banking

Before the pandemic, the need for Blockchain became increasingly evident, but afterward, it became even more apparent. Traditionally, banks used to rely on human connection to win their customer’s trust and grow their customer base but after the pandemic, a staggering drop has been seen in the number of customers visiting their bank branches.

Now, customers prefer to manage their banking activities through digital banking from the comfort of their homes. It results in the reduction of trust among customers in their banks and banking has become more commoditized and price-driven.

To remain profitable and to retain & grow their customer base simultaneously in an ever-increasing competitive market, financial institutions must rely on blockchain technology.

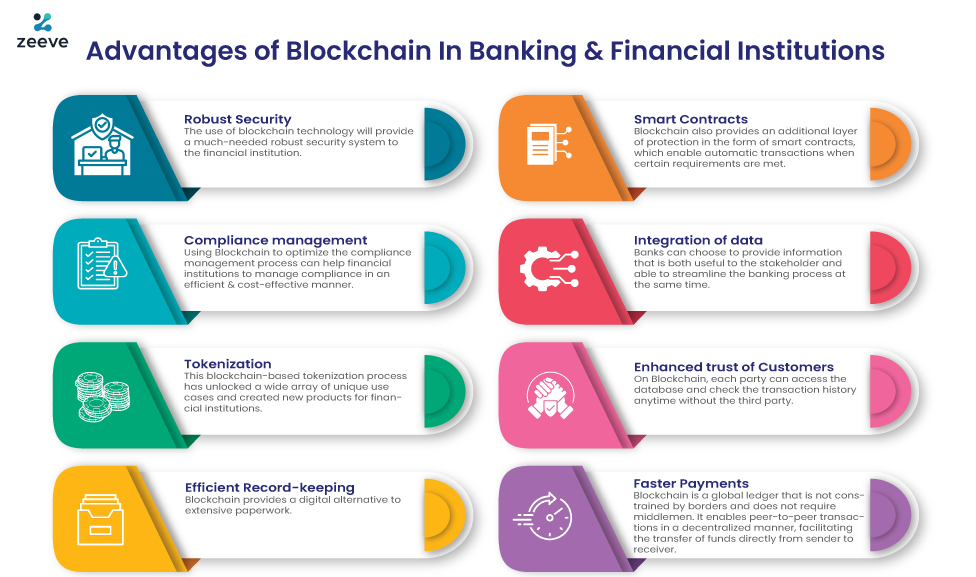

Advantages of Blockchain in Banking & Finance

Blockchain offers different types of advantages to the banking and financial sector, and each advantage can unlock unique use cases for the finance industry that was previously unattainable.

Robust Security

In the last decade, the financial industry has made significant strides in digitizing its process. However, with increasing digitization, financial institutions have become more vulnerable to cyber-attacks. Cyberattacks are considered the biggest threat to the financial industry.

The use of blockchain technology will provide a much-needed robust security system to the financial institution. The community of users present on the blockchain network can see and verify each transaction in the ledger, thereby making the distributed ledger tamper-resistant.

Blockchain averts security breaches by eliminating a single point of failure in a centralized financial institution.

Smart Contracts

Blockchain also provides an additional layer of protection in the form of smart contracts, which enable automatic transactions when certain requirements are met.

Also, in the rare event of a node malfunction, the data doesn’t get lost as it is stored in several other nodes, and the malfunctioned node can quickly regain all the data as soon as it is repaired.

Compliance management:

Globally, money laundering is estimated to be worth around $2 trillion annually. Financial institutions are struggling to comply with safety measures such as Anti-Money Laundering & Know your Customer. This process includes compiling, tracking, and storing massive amounts of data that will later be passed on to regulators. In addition, it is also a slow, fragmented, and manual process which results in delays and client dissatisfaction.

Using Blockchain to optimize the compliance management process can help financial institutions to manage compliance in an efficient & cost-effective manner. In this way, regulators would get real-time access to the customer’s data which is necessary for compliance purposes.

Integration of data:

In traditional banking and finance systems, there is no scope for interoperability and data integration. The data is stored in one central database, and sharing of the data with another party can only be done manually, which takes time and is prone to human error.

Blockchain provides the bank or financial institution an option to share information with other stakeholders. It can choose to provide information that is both useful to the stakeholder and able to streamline the banking process at the same time.

Tokenization:

Tokenization is a process of digitally representing an existing real-world asset on the blockchain. For example, property (tangible or intangible) or financial instruments. The real-world asset is recorded on the blockchain ledger, and the economic value and the legal rights of the asset are linked to its digital representation on the blockchain.

This blockchain-based tokenization process has unlocked a wide array of unique use cases and created new products for financial institutions. The tokenization process is expected to provide greater liquidity to illiquid assets, ensure greater participation of retail investors, and simplify the compliance process for the underlying assets.

For financial institutions, it may result in faster, cheaper, and frictionless tokenized asset transactions.

Efficient Record-keeping:

Most traditional banks are still dependent on paperwork for record-keeping, and this area has been relatively slow to get digitized. The global finance industry consists of trillions of bank records of everything ranging from personal account data to stock market transaction ledgers of individuals.

Blockchain provides a digital alternative to such extensive paperwork. Blockchain’s ability to store immutable records would enable auditors to automatically validate the most critical data in financial accounts, lowering costs and saving time. This will also curtail operational risks such as fraud and human error when recording transactions & reconciliation of records.

Enhanced trust of Customers:

Trust between the customer and businesses is the key component in the smooth functioning of every industry. But the trust factor becomes indispensable in the financial sector. With the growing scandals involving banking giants this element of trust between financial institutions and their customers is dwindling.

Blockchain’s decentralization feature can prove to be instrumental in restoring customers’ trust. In a traditional centralized transaction system, the central trusted agent verifies each transaction and provides access to the database. On the Blockchain, each party can access the database and check the transaction history anytime without the third party.

Faster Payments:

Blockchain using its real-time payment technology, can transform both domestic and international payment systems. Blockchain provides an alternate way of payment and thereby could end the dependency on SWIFT and other payment schemes.

Cross-border payments generally could take 2-7 business days and up to 15 % of fees to transfer a sum of the amount. This is because there are multiple banks involved as intermediaries . Whereas, blockchain is a global ledger that is not constrained by borders and does not require middlemen.

It enables peer-to-peer transactions in a decentralized manner, facilitating the transfer of funds directly from sender to receiver.

Blockchain Use Cases in Banking and Financial Industry

Some of the most established use cases of blockchain in Banking and Financial Services are as follows:

Stock Exchange and Share Trading

The process of trading or investing via the stock exchange involves a lot of intermediaries and complicated formalities. By utilizing Blockchain technology, the number of intermediaries between a transaction, the complicated formalities, and the enormous amount of math it takes to quantify stock prices in real-time could all be improved upon.

Trade Finance

The process of trade finance is still highly manual, takes a lot of time, and deals with a large amount of paperwork. Blockchain could streamline the entire trade finance process by eliminating time-consuming paperwork and bureaucracy.

Digital Identity Verification

Most of the current digital identity verification practices are weak and outdated. Several steps are involved, and the user must go through this process every time they are required to verify their identity. Using blockchain, users will only have to verify their identity once, saving them time and increasing the efficiency of the process.

Crowdfunding

One of the biggest challenges the crowdfunding market faces is preventing fraud and enhancing investors’ trust. Blockchain will provide traceability of funds, resulting in a new level of transparency that will reaffirm investor trust while helping to prevent fraud.

Syndicated Loans

There are several parties involved in the transaction for a single syndicated loan. Due to the participation of so many parties, the process becomes very complex, time-consuming, and costly. By using Blockchain, we can fix these issues and make this process more efficient, secure, and reliable for all the parties involved.

Cross Border Payment and Remittances

The present methods used for cross-border payment and remittances involve too many intermediaries in between. This makes the process lengthy and costly. By eliminating unnecessary intermediaries from the process, blockchain would make cross border payments faster, cheaper, and more secure.

Credit Reports

Third-party credit bureaus create credit reports. Current issues in the credit reporting system are that it involves a third party, it’s insecure, lacks transparency, and is prone to error. By using blockchain, consumers will not have to rely on these inefficient credit rating agencies and will have complete control over their personal data.

Accounting, Bookkeeping, and Audit

Accounting, Bookkeeping, and Auditing are the most integral practices of a financial institution. These processes still rely on a manual workforce and include too much paperwork. By using blockchain to optimize these processes, financial institutions can reduce costs and save time.

Hedge Funds

In a typical hedge fund, the participation of investors is limited to the contribution of their capital. The decisions regarding the investment of these funds are taken by the hedge fund manager. Blockchain can empower those investors that wish to participate in the decision-making process about where their funding will be invested.

Insurance

The biggest pain point for both buyer and seller in the insurance sector is the Claim and verification process. By using smart contracts and its distributed ledger technology, Blockchain can speed up the claims & verification process, lower costs and reduce fraud.

Conclusion

Innovation has always been the cornerstone for the growth and prosperity of any organization. Lack of innovation has frequently caused the fall of prominent industry giants. Hence, if the financial institutions also resist change and innovation, newcomers will soon disrupt their businesses.

Blockchain in banking and finance is the solution for institutions that want to truly digitize and automate their processes. This, in turn, will lead to lower operational costs, general and administrative costs while restoring customers’ trust and increasing the overall efficiency of the institution. In addition, the Tokenization of Assets and Decentralized Finance (DeFi) is opening up a new chapter in the Financial space.

Zeeve

Zeeve is the leading Blockchain as a Service platform helping enterprises and Blockchain startups build, deploy and manage reliable decentralized apps and Blockchain networks. Zeeve is a low code automation platform that is cloud agnostic and supports multiple Blockchain protocols with advance analytics and monitoring of nodes and networks. Zeeve features a powerful set of APIs to build DApps for plethora of use cases across industries. We have experience of more than 5 years designing enterprise Blockchain solutions in Banking and Financial services space. Zeeve supports Decentralized Finance (DeFi) space with decentralized storage, trusted nodes and smart contracts. For more details, schedule a free call with our DeFi specialist.