You can have a great look at something when you are either watching it from a vantage point or going through bottlenecks, plaguing innovation and sustainability. Why’d I say that, apparently, because something unprecedented had only happened when unfavorable circumstances have been put to test. And, seemingly, we are witnessing the same narrative building up in the private blockchain ecosystem.

Why’s that so? In case, you ask me that! Recently, a Cisco’s report has claimed that by 2027, blockchain’s potential could bring 10% of the world’s GDP on it. As someone who had been in the DLT space, it was an intriguing claim but also a hard to earn dream because the financial and banking markets have been walled to a standalone ecosystem for operations.

Breaking the Barrier Narrative: Stuck in Walled Gardens

For a 10% GDP on blockchain, it roughly amounts to $13 trillion. Or, put simply, it is the combined GDP of some of the top economies like India, Germany, and Japan combined. To reach such claims, one has to break the barriers of consensus model, algorithm, hashing and transaction, and interoperability. Why so? Because, to accommodate a 13$ trillion built on top of blockchains, keeping the financial and banking sectors out of the picture makes the dream difficult. However, the present state of technology in blockchains is such that these segments couldn’t standardize operations out of the fear of data breach and compromise of trade secrets.

In this article, we shall look at how that shall be changing in a larger context when private blockchains start upgrading according to the changing environment.

The 10% GDP Dream Through Composability and Interoperability

When blockchains introduced composability, it simplified operations within the same environment. However, in doing so, a key point of failure eventually surfaced in the form of different tech stacks changing transactions, consensus, jurisdiction, hindering interoperability, as a result with an alien environment. And, when you are talking of bringing the entire world on blockchains, an approach of getting pinned to the walls doesn’t appear sustainable. Hence, banking and financial sectors have been meshed in a complex maze which is non-communicative because of the above mentioned differences. This has caused two core problems;

- UX or User experience has taken a severe hit because an asset, which is active in one ecosystem cannot be exchanged with another ecosystem. And in the world where we are increasingly connected through globalization, building solutions around walled-gardens could deter adoption.

- The second aspect is restrictive development of cross-chain use-cases which is essential for solving the capital inefficiency problem. A deterministic factor when you are looking at building an interactive, composable, easy to deploy and operational ecosystem that could sustain the financing and banking market.

Now, to fix this chaos, the need for an unconventional approach is mandated that shall answer to risks like compromise of trade secrets, undue intervention in operational affairs, a single private network and amicability in running different applications on a common shared network that could streamline smooth movement of assets without capital locks and other challenges. Ideally, that’s what universal interoperability sounds like and fortunately the world of private blockchains is all set to introduce a new ecosystem that shall fix these long pressing challenges of interoperability and composability. In this ecosystem, banking and financial institutions would be the key stakeholders who would be benefitting at large with this solution when integrating blockchains in their operation.

R3 Corda and Harmonia: Changing How Banking and Financial Institutions Shall Function

Corda blockchain has partnered with Adhara to launch Harmonia which shall introduce true atomic settlements in the financial and the banking space. The POC has already been demonstrated by HQLAX and Fnality. In the POC, it was seen that two partner networks, HQLAx and Fnality could cross operate using the Corda blockchain & Harmonia ecosystem. In that, HQLAx wanted to settle their trades in high quality cash/fiat money, which was provided by Fnality.

The network participants used the Adhara Network for the transaction in which the transactions were automatically settled with no collateral required by FnPS or Fnality Payment System, which solved the capital efficiency problem in interoperability and the need for representation of cash/fiat was not mandated on HQLAX’s Digital Collateral Registry. Hence, an instant need for validation on both the partner network through capital locking was not triggered, saving protocols or applications built on blockchains in the banking and finance from fragmented liquidity risks. The intriguing part to note was how it was achieved?

Harmonia proposed victory over two core challenges: (i) Elimination of third parties that create a single point of failure obstructing interoperability. (ii) Second was to overcome the bespoke integration challenge when two or more systems want to interoperate. For example, bridges have backfired during cross platform swaps on public blockchains.

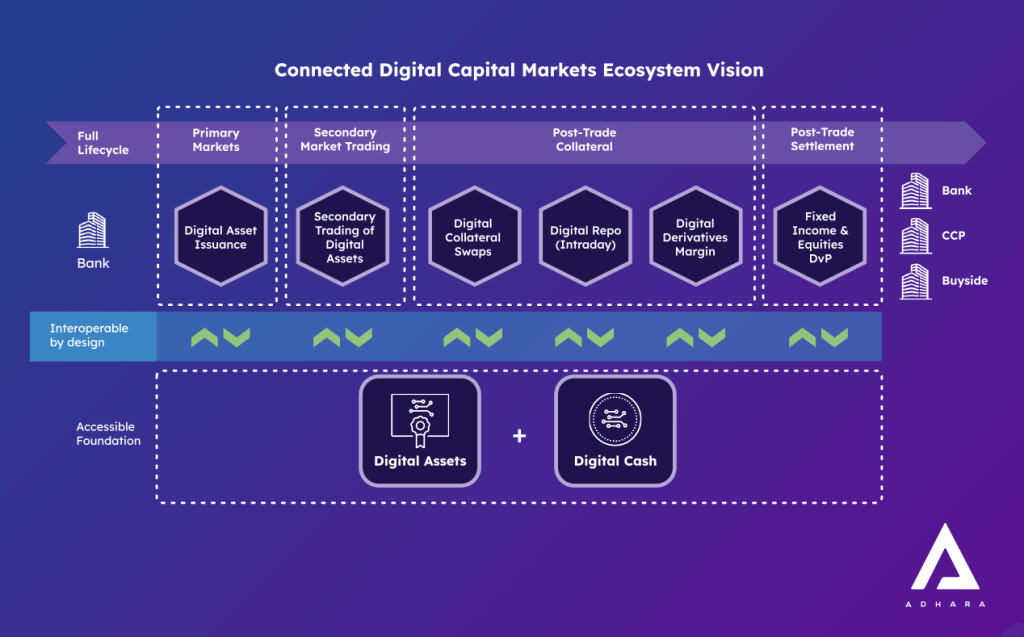

In this model powered by Adhara that triggered the swaps, the EEA standards were used via HyperLedger for targeting different blockchains. As you can see in the above image, the harmonia ecosystem is acting as a bridge with e-Money token standards and EEA cross-chain functionality.

In such a model, Adhara liquidity hub and a digital payment hub are in place to trigger actions across different locations for interoperability among partner networks. The participating networks can operate on Nivaura, Finteum, HQLAx and Fnality platforms to stimulate enhanced interoperability between partner networks, with Harmonia acting as a crossover for all chains with an open network stack capable of audit and having no monolithic standards, which means, any applications built in the financial and banking sector can interoperate with their partner network, without defining specific walled guidelines and models, obstructing interoperability.

Thus opening the doors for not just the private blockchains like Corda blockchains and others but even the public ones under the EEA alliance to interoperate. The open source general purpose framework as deployed by Hyperledger Cacti and YUI, a Hyperledger Lab, has acted as the base for building technology stacks that could easily interoperate with different blockchains, irrespective of their technology stacks and consensus models.

Banking and Finance Empowerment Through blockchains: A 10% GDP Contribution Likely Turns Real

Banking and finance want the best of both worlds: (i) The high level security of the public blockchains without compromising scalability (ii) Elimination of single point of failures which is often prevalent in private blockchains to ensure scalability. Since Corda blockchain has partnered with Harmonia association, it shall bring multiple projects as anticipated with the likes of DataChain, Progmat and multiple other names, the security and privacy concerns while dealing with a hybrid public-private model would be solved through R3 Corda blockchain and Harmonia fusion.

In addition to this, , Corda blockchain is introducing regulated entities (platforms like Fnality, HQLAᵡ and others) as well as the banks who are shareholders in those platforms, we can certainly hope that in the future there will be many contributors and some of those may be using other (non Besu/Corda) tech stacks. Hence Corda blockchain has envisaged a path-breaking interoperable blockchain village targeting every sector, not just finance and banking. Moreover, in all probabilities, we also see a multi-dimensional tech stack evolving which shall be making operations less monolithic and more inclusive of dynamism with respect to changing regulatory guidelines, safety standards, privacy concerns and developers compatibility.

How could Zeeve help?

If you are planning to build something with Corda blockchain in the finance sector, reach out to us. We will set up your network with minimal turn around time, achieving faster time to market. Check out our Corda Page to see what all we offer and how Zeeve can simplify your development experience on Corda blockchain.