The financial industry is transforming. Blockchain and digital assets are innovative technologies gaining traction as they will enable the use of finance in a decentralized manner across borders. The next stage of expansion has been coined “DeFi“–a contraction from Decentralised Financial Institutions. In this blog, we would explore how they differ from traditional financial institutions, their pros, and cons, and also the potential of investing in this revolutionary technology.

DeFi combines cryptography with finance and software development all wrapped up in jargon that can be a little difficult for beginners to understand without some background knowledge on the subject matter beforehand! This blog piece attempts to shed light on the next generation of financial services that operate as an automated process, developed on a blockchain, and show the potential of totally wiping out the traditional banks.

Decentralized finance is one of the most ground-breaking trends in the financial technology space today. The idea of decentralized finance or DeFi is not new, but it is only over recent years that it has gained traction in the fintech world. It offers a unique experience, which is far different than the traditional banking systems and opens up limitless possibilities in the mainstream financial world that were not available before to investors and customers. The decentralized and transparent nature of DeFi along with smart contracts allows for seamless, transparent and trustless transactions.

The market for decentralized finance is booming again with total value locked up across leading protocols reaching an all-time high of $259.41 billion in December 2021. According to experts, the industry is expected to touch over $6 trillion by 2025 with an accelerated rate of DeFi adoption in the financial world.

What is DeFi?

DeFi or decentralized finance as it is primarily referred to as is all about decentralizing traditional financial services and providing a working model that features borderless, permissionless access to finance. Built on blockchain technology- the DeFinance Ecosystem will ultimately offer uncensored international currency exchanges without restrictions or censorship!

The development of DeFi has enabled the use of financial services on a decentralized blockchain network that is open to everyone. Its implementation means individuals no longer need to go through an intermediary like banks or brokerages, as anyone can utilize them thanks in part by eliminating third-party intermediaries such as brokers who charge fees for providing this service. It can be used by anybody with no requirement for a Social Security number such as Aadhaar Number and government-issued ID card, thus making DeFIs accessible to everyone!

Smart Contracts supplement DeFi

Financial applications pertaining to lending, borrowing, and trading are generated through smart contracts implemented by specialist Decentralized Application (DApp) to facilitate a fully peer-to-peer transaction.

The introduction of DeFi provides people with access to financial services while also helping them to retain full control over their assets as opposed to traditional centralized systems. As most code used in DApps are converted into Ethereum transactions that anyone can view, it breeds transparency.

For instance, when you buy a coffee, there is an intermediary between yourself and your business. This person can take control of your transaction or record it on their ledger. In modern-day finance, this middleman is cut out because we use decentralized technology which means no single entity has total power over any given situation like they did before cryptocurrency became popular!

Appeal of DeFi: Disrupting traditional finance

The invention of Bitcoin in 2008 was the first major disruption to traditional finance. The cryptocurrency also paved the way for DApps when it took off with DEXs a few years later, touching every corner and making its mark on people’s lives around the world!

In monetary terms, DeFi is compared to Lego blocks, being touted as “money lego”. The term comes from how these blockchain-based assets can be stacked on top of one another in order to get as much value out of them. The incredible yield farming returns can be unlocked by stacking DeFi protocols in an open-ended and permissionless way, just like in a lego set. You get to pick and choose which pieces go together, depending on your needs for the day!

Compared to a Centralized Crypto Exchange (CCE), Decentralized Exchanges offer more security and stability. Platforms like Coinbase Pro or Binance are CCEs because of how they store funds on behalf of users’ assets, which makes them vulnerable in case security is compromised and there is manipulation by the exchange.

The beauty of DeFi lies in its capabilities as a technology to provide access to a borderless, open alternative with enormous potential to disrupt all kinds of financial services possible – savings accounts, insurance loans, and trading. A peer-to-peer network keeps records identical across thousands of computers via blockchain technology which makes it a more secure option than traditional finance with its single point failure mode.

Furthermore, Central banks in some developing countries can be inaccessible for people with low income. They often take a commission from intermediaries, which creates more problems than it solves. DeFi and blockchain-based financial products are new innovations that offer an opportunity to break down barriers that have previously kept poor people in these nations from participating in modern economies with ease!

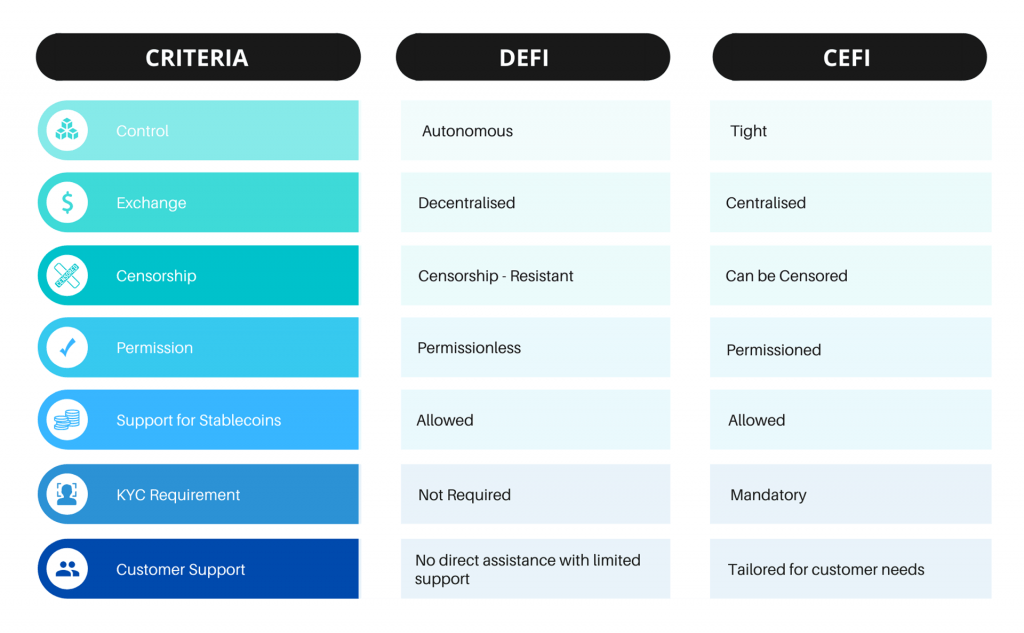

How different is DeFi from traditional finance?

DeFi is a new type of financial service that combines elements from other services. It differs from traditional finance more in its manner in which it facilitates the services rather than the services themselves. Let’s compare the fundamental processes of DeFi and traditional finance with the basic building components of both services and explore the differences between both.

Distributed trust in a decentralized financial system is governed by public blockchains. In contrast, legal and licensed banks act as the governing body for traditional finance within established frameworks of law.

Decentralized finance is the future of financial markets because it provides more transparency and accessibility than traditional systems. Anyone with programming skills is able to create their own tools on top of public blockchains, which has led to this technology’s growth over recent years!

In contrast, the traditional finance system has been unable to embrace emerging trends. One major reason for this inability is due in part to regulations that make it difficult and time-consuming processes just like getting licenses or authorization from regulators on your own terms – which limits innovation within these systems themselves.

Pros of DeFi: Future of finance

In the traditional financial systems, people were stuck when it came to how they invested their money. But with the arrival of DeFi and blockchain technology, there is finally some hope for investors and users to break free from prying eyes on matters of their finance. Investors are also free from third-party interference as DeFi provides access through smart contracts instead of relying on intermediaries like banks or brokers who might take a percentage at any given time.

This new system gives business-to-business relationships an opportunity for disruption as well because smart contract-based solutions will become increasingly popular among institutions joining the blockchain ecosystem and tokenizing real-world items such as stocks or derivatives – all while disrupting traditional ways that have existed before!

DeFi can help unlock the value of these illiquid assets by providing security and transparency. With its public ledger, corporations will be able to detach their tradable fractionalized tokens from any single business or geographical location on a blockchain as well as gain access in markets where they previously had none at all!

Cons of DeFi: DeFi’s strength can also be its weakness

The DeFi industry holds immense possibilities to democratize the finance industry but it is still in its infancy and it runs a number of risks that participants need to consider before resorting to its application. The potential risks can be categorized into three categories as below:

Technological risks

Ethereum is a popular blockchain for DeFi projects, with some of the largest ones using it. However, it is far from flawless. As more people start to use this technology, it is exposed to the risk of greater attacks and also network congestion. The sheer maintenance of records and databases across networks, large-scale computing is done on it slows down the network and also drives up the transaction fees. It can also result in failed transactions and liquidation issues. Even as Ethereum developers are making attempts to improve the congestion issues and other technological risks posed by it to make it scalable, crypto firms can try other popular chains such as Avalanche or Solana.

DeFi platforms are not immune to the cybersecurity threats that other financial services operations face. In fact, they’re one of many targets for hackers looking into popular industries such as crypto trading and money transmission businesses like DeFi providers who store client funds in exchange wallets or custodial accounts on their behalf

A major challenge faced by developers working with decentralized finance applications is how to best protect transactions from would-be scammers trying to steal user information while simultaneously preventing malicious activity during application use.

Investors are increasingly relying on financial transactions, but even the slightest of hiccups in data security could lead to significant losses. To address this risk many brokers offer insurance to protect against hacks or malfunctions with your software. However, it is important that users know what they’re getting before purchasing such coverage so you can make an informed decision for yourself!

Asset Risk

Built on the Ethereum blockchain, the collateral used in DeFi transactions is typically cryptocurrency, whose value can be volatile, especially given the current climate where they are unstable. This creates risks for both investors and financial institutions. Investors may experience losses if their value decreases drastically or even crashes completely, while also hurting institutions that depend on this funding as they will no longer receive payments from customers due to lack thereof.

When people that are panicking sell their DeFi tokens, it can result in major crashes. This is unlike fiat currency which experiences much less volatility and a more predictable pattern of price changes over time. With high rates of return, early DeFi apps attracted new users and deposits by promising large payouts in their tokens. These tokens are usually very volatile which makes them unattractive for investors looking to keep their money safe.

Regulatory compliance risks

This revolutionizing space called the DeFi is still in its nascent stage. Decentralized financial entities can be found operating outside the regulatory framework that often characterizes traditional banking and financial institutions. Even though they facilitate users with automated transactions replacing the role played by banks as intermediaries in this space, it also creates several risks due to its lack of transparency. The obscurity of peer-to-peer transactions results into uncertain environment because there’s no one regulating them, tus amplifying the regulatory compliance risks for participants in this space.

Many DeFi platforms are in a state of confusion about their regulatory obligations. Without clear guidance from agencies, they face massive and intricate compliance considerations that range from anti-money laundering to consumer protection laws.

Jumping on the Defi Bandwagon: DeFi Apps

A new way for beginners to get involved in the world of DeFi is by investing in CCEs that offer tokens related to it. These are called “DeFi Liquidity Mining Funds” and provide an opportunity to not only make 40%-100% passive income but also learn about how this exciting industry works! You can make your token selection easier by checking out the top performing DeFi tokens.

Decentralized finance, an emerging technology that has yet to take off in mainstream society but shows potential for changing how we do business financially, is already giving people hope by offering them access and experience with some of the below remarkable DeFi apps!

· DAI -The DAI app is a decentralized finance application that recently ranked as one of the most popular Ethereum smart contracts. It has gained traction among cryptocurrency investors, and you can use it to invest in various types of assets including stocks or bonds.

· UniSwap – The idea of Uniswap, a decentralized exchange (DEX) created by Hayden Adams from New York is the result of posts written on Ethereum founder Vitalik Buterin’s personal blog about developing an automated market maker and DEX. The project has facilitated over $1 billion in crypto trading.

· Aave– Founded in 2017 by a law student, Aave is a DeFi platform that lets users lend and borrow crypto tokens with ease.

· Bancor Network – The Bancor Network is a revolutionary way for people to trade cryptocurrencies that has been gaining traction over recent years. The company behind it plans on using Smart Contracts, which will allow users to access tokens directly from their wallets without having an account or providing private information such as passwords. No longer must you wait for an intermediary like your broker, as this allows users to buy and sell coins directly from each other without any third party involved in transactions!

Other DeFi Apps

· Cardano.

· Dharma

· Chainlink

· Polkadot.

· Terra Luna

· Polygon

· Solana

Path Ahead: Possibilities of decentralized finance

Decentralized finance is ground-breaking technology. It’s the future of banking, and it will drastically change how we do business as humans in this world today! The one thing that stands out about decentralized finance? You can get your finances without having to deal with all those hassles from financial bureaucracy.

The future of finance is DeFi, and it’s a serious disruptor. It’s an evolving system that institutions must adapt to or they will be left behind in this new economy, but it will take time for the general public and even banks themselves to understand how things work with debt and equity markets on blockchain technologies just yet. It will be a while before this becomes mainstream adoption because of its complexity and time required for adoption by the general population. It’s time we educate the public on how this technology works and benefits in the finance space so that it can be adopted at an accelerated rate!

Since Defi uses blockchain, there is a greater degree of transparency. With transparency comes a new level of due diligence that was never before possible. With every part of the blockchain easier to identify, it’s become an even more powerful tool in fighting fraudulent behavior and improving trust between businesses with their customers.

As developers seek out ways for their project’s success on DeFi, they will also require additional monitoring tools as well as insurance policies. These initiatives are crucial if we want this new market segment to continue growing exponentially into next year.

With DeFi still in its early phases of development, institutions will be at the forefront of shaping this new ecosystem. They can create revenue opportunities by exploiting current infrastructure and running services like never before with their own funds or through partnerships to take advantage of these revolutionary technologies- all while making an impact on society’s most pressing problems! Regulators and financial institutions around the world are taking notice of DeFi, realizing that this marriage between blockchain technology and crypto will undoubtedly bring about new heights in terms of accessibility for everyone.

Zeeve’s DeFi Solutions

Zeeve is a platform that offers Blockchain as-a service (BaaS) to help enterprises and startups build, deploy & manage reliable decentralized apps. The system includes low code automation tools for cloud independence along with advanced analytics on nodes/nets in order to produce metrics reports tailored specifically towards your needs! With their powerful API set you can design DApps across industries seamlessly using DeFi space like trusted storage or smart contracts without any hassle at all.

We have years of experience and guarantee client satisfaction. We showcase our passion along with integrity in both the workmanship and authenticity of all we do here at Blockchain Enterprise Services. We are a one-stop destination for the best-decentralized finance solutions! Unlock the high-value propositions in Defi protocols and contracts with a DeFi solution that is tailored for maximizing user experience.