Traditional financial institutions have always gone for safer havens for investments like bonds. But bond yields in developed and developing countries have always remained lower than the prevailing inflation. For example, in 2025, in the US, the bond yields for 5 years stayed at 3.60% – 3.70% in most countries for the last 5 years, while the average inflation stood at 3.5%. Likewise, in the European region, average inflation stood at around 8% while the ROI on bonds stood at around 3.71%.

Due to this, institutions are now looking for alternatives to maximize their yields. In this regard, crypto staking has ended up as an amenable option because almost all major protocols have surpassed what traditional investment vehicles are generating at the moment.

But crypto staking is not as simple as you might be thinking because you have to run nodes to validate the chain to gain returns. For that matter, you need an infrastructure supporting your pursuit. In this blog, we shall deep dive into understanding Staking-as-a-Service, how it works, and why it is trending in 2025. So, without any further ado, let’s get started.

What is Staking-as-a-Service (StaaS)?

Staking-as-a-Service allows crypto holders to delegate tokens to professional node operators without running the whole infrastructure themselves. In traditional staking, an individual locks up their holding to participate in network validation.

This helps the blockchain in maintaining its network security. In return, the holders are given staking rewards. However, to participate in the validation process, holders must set up infrastructure that enables them to run validator nodes. This process can be challenging for many individuals, and the setup costs are also high. This is where StaaS comes to the rescue.

In the StaaS model, a service provider handles all the technical and hardware requirements on your behalf. This includes the complex validator setup and the required maintenance activities. You simply lock your tokens through a web interface or API, and the StaaS provider stakes them into the network. In return, you earn a share of the block rewards, just as if you ran your own validator. That being said, let’s understand how this process works.

How Staking-as-a-Service Works?

Select a StaaS provider: The process begins by choosing a trusted StaaS provider that has the necessary infrastructure to handle the complex requirements.

Delegate tokens: Next, you delegate the desired amount of your tokens to the provider by connecting your wallet. Importantly, the custody of your keys lies with you. This is because the service only requires a validator key and not a withdrawal authority.

Validation: The provider then runs enterprise-level nodes to participate in the network validation of the blockchain. A great Staking-as-a-Service provider constantly monitors the performance of the infrastructure and manages upgrades in real time. They make sure that the node remains online to prevent downtime and any slashing penalties.

Earn rewards: As the blockchain generates new blocks, your delegated stake earns a pro rata share of the block rewards or transaction fees. The StaaS provider keeps back a percentage of the rewards as commission, and you get the majority in your account. These rewards accumulate in your staking account and can be seen in real-time on a dashboard.

Compound staking growth: Once you have received the staking rewards, you can either claim them or they will be automatically re-staked to generate additional returns for you. This way, you will also enjoy the rewards of compounding without putting any effort into it.

The StaaS process is where the real value is. It involves a bunch of complex steps, but a great provider has them automatically streamlined to make the whole experience smooth. The core advantage of StaaS is that your participation in the process is minimal without losing control over your funds.

Why Staking-as-a-Service Could Be A Bridge Between DeFi and Institutions?

So, why is Staas ending up as a bridge between institutions and DEFi? A few reasons driving the shift;

1.Institutional Participation

Several traditional finance players are actively participating in crypto staking. Even major institutions and banks now support PoS staking. For instance, Anchorage Digital, a federally chartered bank in the United States, now offers staking services for institutions.

We're thrilled to welcome @Anchorage as one of our new industry members to TDC. As a global crypto platform, they enable institutions to engage in digital assets through a comprehensive suite of services, including stablecoin issuance, trading, custody, settlement, staking, and… pic.twitter.com/6KJSJG8AZu

— The Digital Chamber (@DigitalChamber) August 18, 2025

Additionally, Switzerland’s SEBA Bank provides crypto custody and lending services to its clients globally. Moreover, Coinbase Custody also offers fully secure and compliant staking services.

Several asset managers are also catching up. Canadian fund 3iQ launched a Solana Staking ETF (SOLQ) on the Toronto Stock Exchange in 2025, highlighting demand for staking-backed yield in a regulated space.

3iQ Solana Staking ETF (TSX: SOLQ, SOLQ.U) and 3iQ XRP ETF (TSX: XRPQ, XRPQ.U) record largest AUMs in their respective categories!

— 3iQ Digital Asset Management (@3iq_corp) September 9, 2025

We're excited to share that investor demand sees $SOLQ surpass CAD 300 million and $XRPQ exceed CAD 150 million in AUM. Launched earlier this year,… pic.twitter.com/ABSPdnfqBZ

This institutional momentum suggests that PoS rewards can be a valuable addition to modern investment strategies. One key reason for this increased interest is the current US Government’s positive stance towards crypto. Multiple ETF approvals, the GENIUS Act, and the recent SEC staff statement regarding staking activities are key examples.

Moreover, staking’s additional and predictable returns are becoming an attractive venture for institutions. As a result, fund managers are taking staking as a gateway to diversify portfolios, making it a hot favorite in 2025 for institutions and DeFi bridging. In this pursuit, Staking-as-a-Service has ended up as an amenable solution because it abstracts all the complexities to set up your node and participate for benefits.

2. Staking Yields vs Traditional Finance

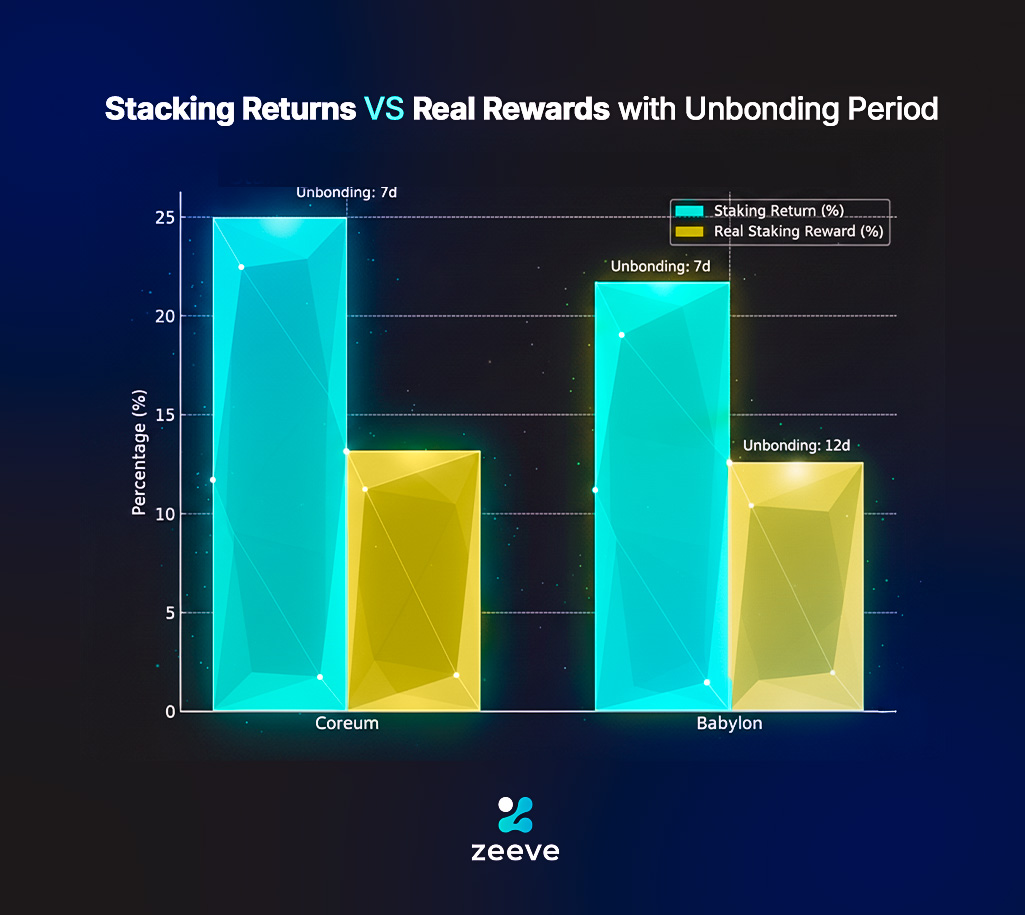

An important reason why staking-as-a-Service is attracting more investors is the high yields compared to traditional finance players. For instance, the US 5 Year Note Bond Yield is about 3.68% currently. This fails to beat inflation. Moreover, savings bank interest also hovers around 4-5% annually.

As evident from the graph above, in the last 10 years, the yield that crypto has generated has outsmarted traditional financial instruments like bonds and savings at around 7% and rising, pushing the narrative of staking yield to occupy center stage. With Staking-as-a-Service, institutions are getting the gateway to explore the hidden yields of DeFi in a low-yield traditional bond-bearing environment.

3. Complexity & Compliance

Running validators in-house is challenging, which keeps institutions away from staking. For example, if institutions want to integrate the same, they have to build everything from the ground up, like secure key management, a 24/7 validation system, monitor slashing risk, and meet regulatory KYC/AML audits. Moreover, institutions deal with huge amounts of capital, which increases the stakes and the seriousness regarding the risk of theft.

To outsource these complex yet important tasks, institutions choose StaaS providers. The latter helps them with the infrastructure to minimize technical and regulatory headaches. In addition to this, Staking-as-a-Service also helps in diversifying the use cases of DeFi, where, for the first time, institutions can tap unexplored goldmines like native staking, delegated staking, liquidity staking, and liquidity pool participations, which are advanced use cases attracting major institutions.

That’s why institutions are finding Staas as an effective gateway to explore the profitable realms of DeFi. But when they are doing the same, there are a few things that they should consider firsthand to explore them.

Top Determinants While Choosing a Staking-as-a-Service Provider

Before you make a move to choose a Staking-as-a-Service provider for your staking pursuits, there are a few things that you should look into;

Custody Model: This is a very important factor. The custody of the key should remain with you so that you retain control. Look for a non-custodial StaaS provider that never takes possession of your tokens. This model ensures safety for your funds. For instance, if the infrastructure of the provider is compromised, your funds will remain safe if in your custody.

Security: While selecting a StaaS provider, you must make sure that they use enterprise-grade security measures. Check for industry certifications like SOC 2 Type II, ISO 27001, etc., and strong operational controls. For instance, you should look for platforms that provide 24/7 security monitoring and tools to manage your nodes. There are several privacy and compliance measures in place, too. In short, your provider should have rigorously audited multi-layer security and provide transparency.

Reliability & Uptime: Validator downtime results in lost rewards and potential slashing. Look for StaaS providers that guarantee 24/7 availability. Top providers deploy nodes across multiple cloud regions with automated failover. This, along with other factors, helps in maintaining a high uptime of 99.5%.

Delegators want reliability.

— Zeeve (@0xZeeve) September 15, 2025

Zeeve delivers it.@CoreumOfficial validators powered by Zeeve are:

✅ Secured from threats

✅ Uptime-guaranteed

✅ Transparent & monitored

Safer infra → Safer delegation → Stronger Coreum.

Start delegating with confidence today:… pic.twitter.com/gVI3od5DcL

Fees: Then, you must be clear about the commission or fees charged by the StaaS provider. The core reason for staking is to earn returns on your funds. So, a transparent fee structure helps you in deciding whether you should go with a certain provider. Ideally, choose a provider with low commission to maximize your gains.

Support and Reputation: For large delegations, 24/7 support and a solid track record are particularly important. Research the provider’s reputation. Have they run validators for other projects or clients? Do they publicly share their uptime statistics or undergo regular audits? Community feedback can also give insight into the responsiveness and reliability of a provider.

By carefully looking for these factors while choosing a StaaS provider, investors can select a partner that understands their risk profile and supports their needs.

Delegate Your Tokens with Zeeve Staking–as-a-Service

Zeeve’s platform provides a well-engineered Staking-as-a-Service for investors. Here are some key features:

Non-custodial by design: Zeeve never asks for users’ tokens. Investors delegate their tokens from their wallet and maintain complete control of their funds. Zeeve only receives a validator key, not the private key to withdraw funds. You can check Coreum and Babylon.

1-Click Delegation: Just pick a network, choose Zeeve validator, and confirm. That is all you have to do to start earning your staking rewards.

Enterprise-grade infrastructure: Zeeve operates validators with institutional-grade reliability. The stack is SOC2 and ISO-27001 certified, with multi-layered deployment to maintain a 99.5% uptime guarantee.

Low commission: Zeeve charges a commission of 3%, which is the lowest among active validators. So, you retain more rewards to earn high long-term yields.

Transparent systems: Zeeve provides real-time analytics for investors to track important metrics like validator health, commission history, rewards, missed blocks, etc.

24/7 Support: You get constant support and continuous monitoring. For large or institutional delegations, Zeeve offers dedicated support, runbooks, and priority incident channels.

Automatic protocol support: Zeeve is already an active validator on multiple PoS chains. For example, Zeeve runs a Babylon ($BABY) validator on the Cosmos network and a Coreum validator on its BPoS network.

As you can see, Zeeve fulfills all the requirements of a great Staking-as-a-Service provider. It focuses on maintaining a safe, transparent, and reliable platform for investors.